×

- Home

- About Us

- Services

- QuickBooks Online Help

- QuickBooks Data Migration

- QuickBooks Solopreneur

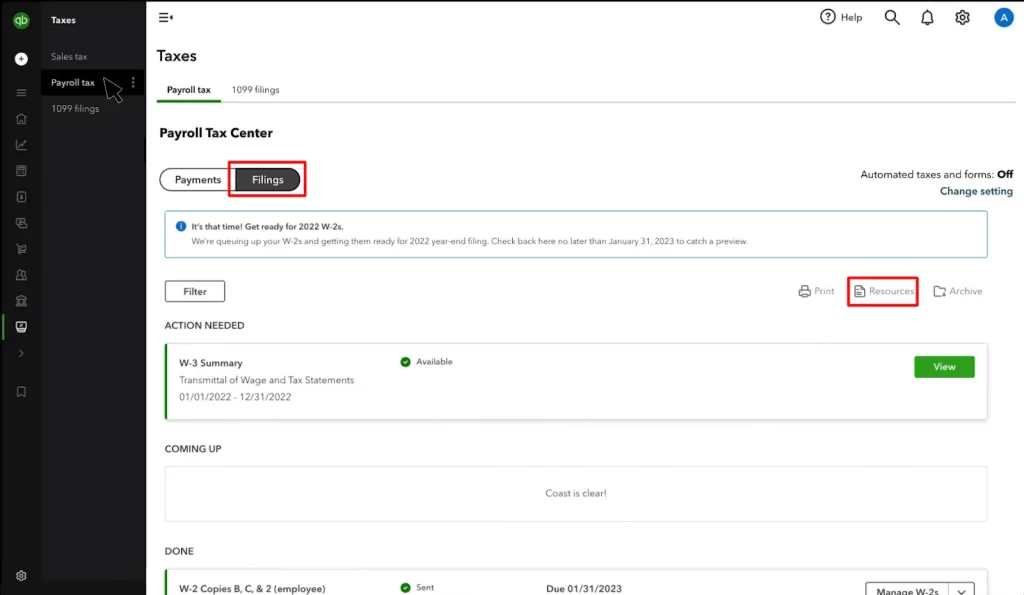

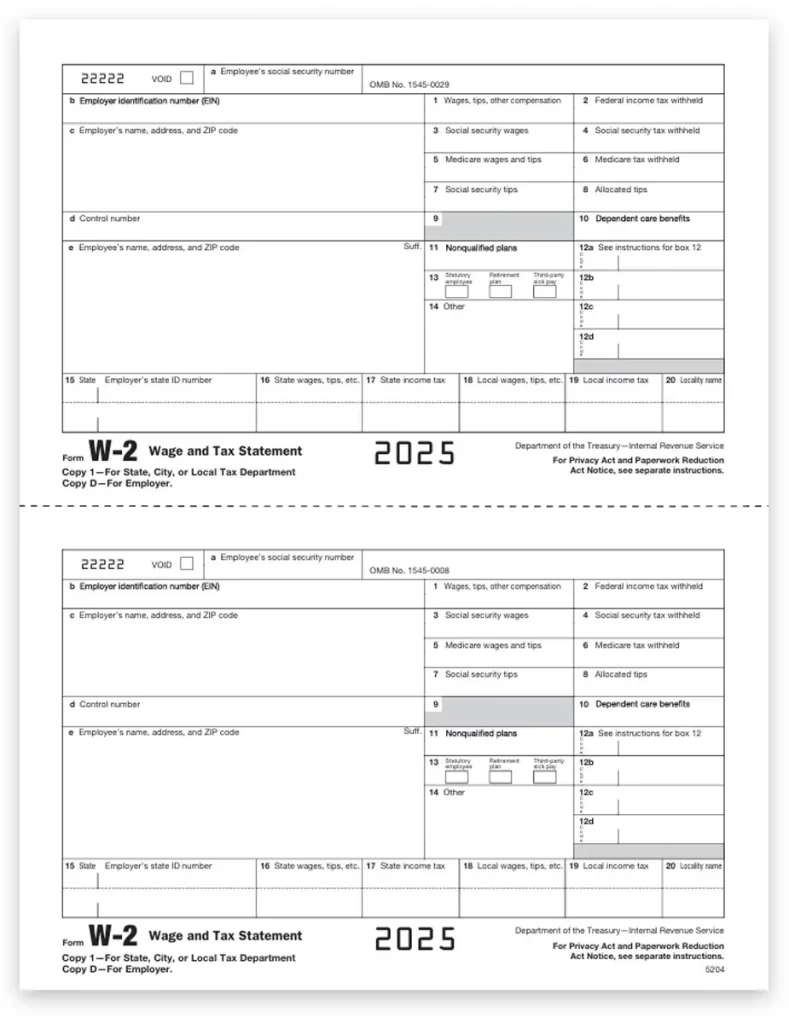

- QuickBooks Online Payroll

- QuickBooks Integration

- QuickBooks Desktop Payroll

- QuickBooks Desktop Enterprise

- QuickBooks Data Recovery

- QuickBooks Data Conversion

- QuickBooks Cloud Hosting

- QuickBooks Canada

- QuickBooks Desktop Help

- QuickBooks Point of Sale

- QuickBooks Payroll Help

- Blogs

- Contact Us