Form 941 is one of the most important IRS forms that is used by businesses for reporting employment taxes. It also reports federal income tax withholding, Social Security tax, medical care, and other medical taxes. For filing the form, you can also use the QuickBooks application once you create yourself as a Reporting agent and are authorized to e-file returns....Read more

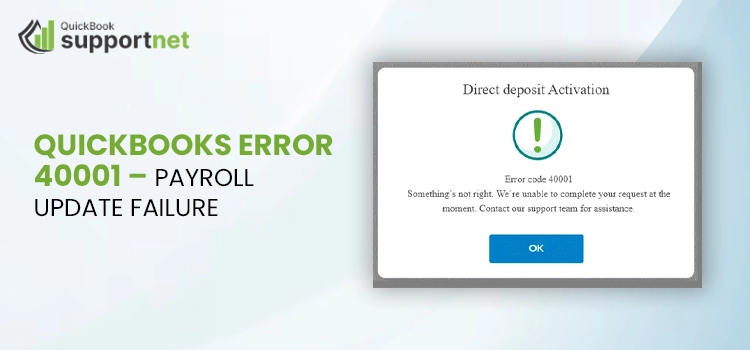

QuickBooks Payroll provides its users with a direct deposit feature to pay their employees directly into their bank accounts. Moreover, this feature streamlines the payroll-related tasks and minimizes the issues occur while preparing checks. However, sometimes users come across QuickBooks Error 40001 when activating direct deposits. At times, this issue may strike due to improper network connectivity or incompatible software...Read more

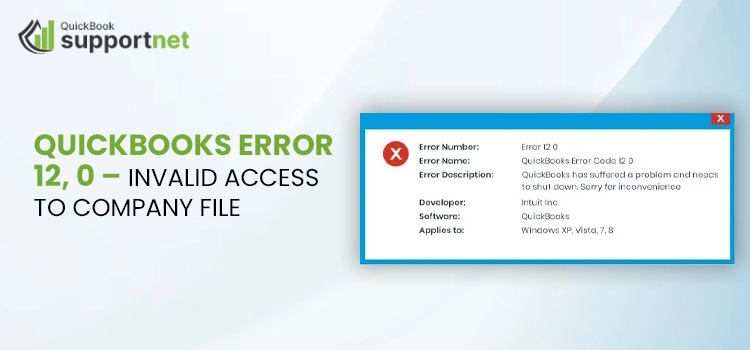

QuickBooks is the most suitable accounting software developed by Intuit. The powerful tool is widely used by all-size businesses of various sectors to manage their financial task. It generates payroll, keeps track of transactions, creates invoices, manages inventories, and much more. However, despite being the most powerful accounting tool with advanced features and functionalities, it is prone to errors. There...Read more

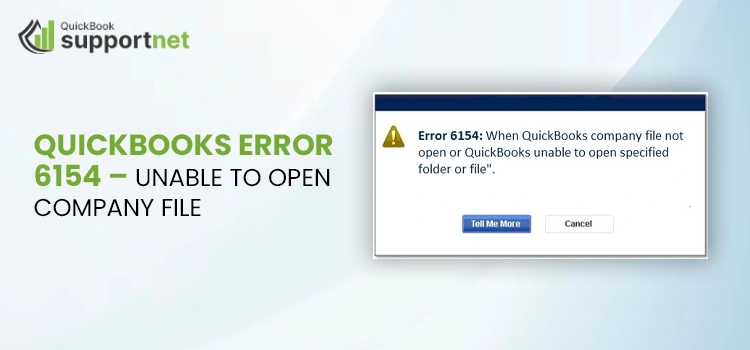

QuickBooks Company file contains all the sensitive data related to your company and employees. No company can even think of putting the data file at risk as it holds the most crucial data. But sometimes, users fail to access the company file due to QuickBooks Error 6154. Wondering why it happened? It might occur while using an outdated version of...Read more

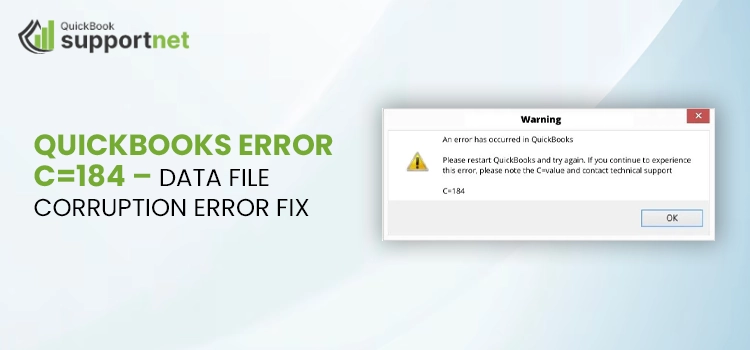

QuickBooks error C=184 is a common issue in the program that can take place due to damaged network data (.ND) or transaction log (.TLG) files. However, this is not the only reason; several other possible factors can also bring forth this error in the QuickBooks application. For instance, when reporting dates of the QuickBooks Desktop don’t match due to 29...Read more

QuickBooks enables users to connect their bank to the program so that they can keep track of their income and expenses. Also, reconciling your bank account with QuickBooks helps you know if there are any discrepancies in the transactions. However, there are multitudinous issues related to the bank account in QuickBooks. QuickBooks Bank Error 105 and 102 are some common...Read more

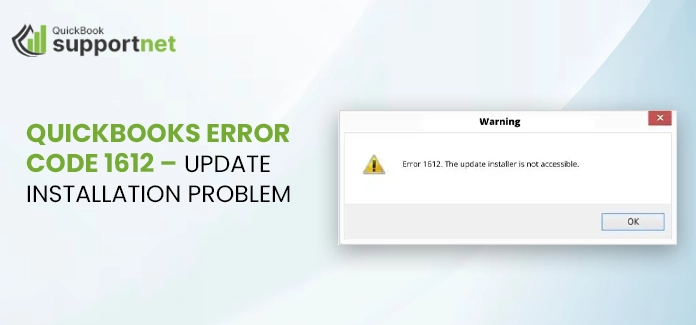

QuickBooks Error 1612 is an error that occurs in your System due to an interruption in the installation of the QuickBooks Software. However, the steps to rectify this Error are not so difficult if you know the set of steps. Thus, if you are also facing this Error, and don't know how to resolve it, simply read this blog and...Read more

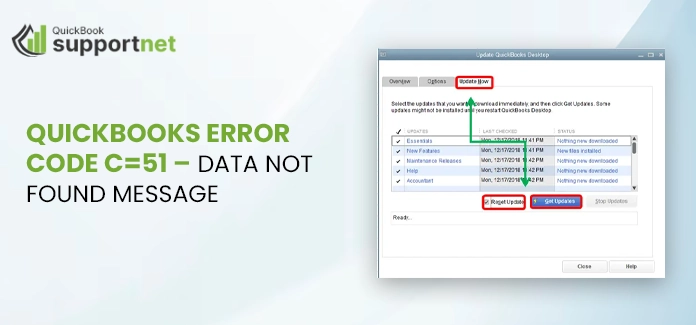

Is your system displaying QuickBooks Error Code C 51? Well, if yes, go through this simple guide to know the possible reasons and solutions. QuickBooks Error Code C=51 is one of the most unexpected errors that can arise in the program. There might be many possible reasons behind this error code; sometimes QuickBooks fails to find the TxList file, and...Read more

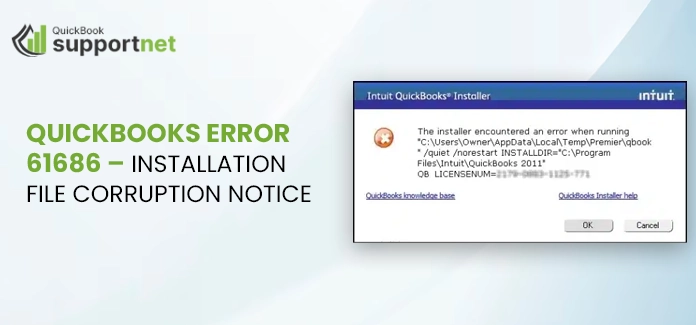

QuickBooks is home to powerful accounting features; however, technical issues are also an integral part of the user experience. One such issue is QuickBooks error 61686, which can come into the picture when installing or updating the QuickBooks application. This error can cause disturbance in your accounting processes; hence, you should fix it instantly to mitigate its impact. The users...Read more

QuickBooks error 502, also referred to as the QuickBooks Bad Gateway error 502, is one of the most annoying issues in the program. It not only hampers the performance of the QuickBooks application but also affects the other web-based applications running on your Internet Browsers, such as Google Chrome, Mozilla Firefox, and several others. Invalid response from the server is...Read more