QuickBooks is the most popular accounting software used by millions of people to meet their accounting requirements. Every year Intuit rolls out new versions of QuickBooks with improved features and tools for a seamless business operation. But just like any other software, the robust application faces errors or technical glitches. Though some QuickBooks error 3180 can be easily resolved by implementing common troubleshooting methods, some need expert advice.

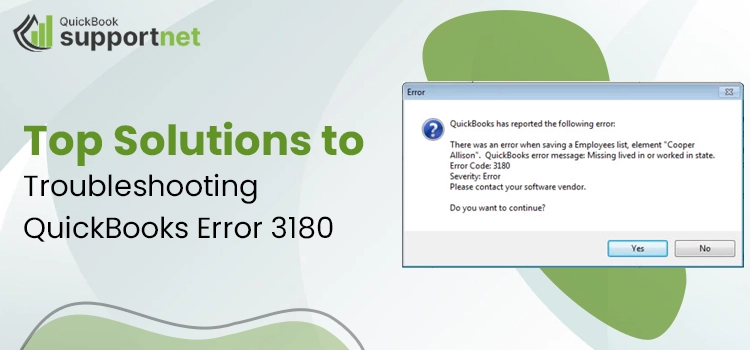

One such issue that the users face is QuickBooks Errors 3180 when they are trying to save the sales receipt. This error can abrupt the application to track the overall sales if not resolved quickly.

Troubled by error 3180 QuickBooks? Give a Call at +1-855-603-0490 & Get It Fix Immediately.

Unlike the other QuickBooks error, this error is a little difficult to get resolved. If you are getting troubled by this error, then do read this blog. We will discuss the causes of the error, its symptoms, and the various troubleshooting methods. However, before diving deeply into the pool of knowledge, let us have a quick look at the error.

Brief Overview of Error 3180 QuickBooks

The regular updates of the QB increase the complexity of the robust application. Due to this, most of the users face the connex for QuickBooks error 3180. Apart from it, you may encounter an error when you use the wrong type of QuickBooks Desktop account in mapping the QuickBooks Desktop Point of Sales account. When the user encounter with this glitch, an error dialogue box with the error message “Status Code 3180: An error is occurring while trying to save a sales receipt.” pops up on their screen.

Apart from it, the point of sales tax error displays different error messages. We have jotted down some of the error messages for your convenience.

- Status Code 3180: An error is happening as you attempt to preserve a sales receipt.

- 3180 Status message: An error emerged while saving an Employees list, element “Employee, Name”

- Status 3180 code: A QuickBooks error notice occurred while saving the General Journal Transaction.

- Status code 3180: There should be a vendor on the A/P (or A/R) detail line.

- Status code 3180: QuickBooks error message: The posting account is invalid

- 3180 Status code: Status message: There should be a seller on the sales tax information line.

What Causes Error 3180 QuickBooks

Before we deep dive into the technical pool of troubleshooting methods. Let us know the various causes of the error. Knowing the exact cause of the error is important as it helps you in picking the right resolution method. The list of the factors which trigger the error is long; however, we have pinned down some of the most common reasons why you face this error.

- The company file might be damaged or corrupted.

- In case you have selected more than one Item in the payable account of sales tax as a target.

- The anti-virus or the firewall setting is conflicting with the program resulting in the error.

- In case no vendor is logged in, sales tariff receipt.

- The incorrect account mapping of sales tax payable.

- A paid-out was generated using the sales tax payable account.

- The incorrect or damaged type of payment item will result in an error.

- The incorrect account settings of unpaid sales tax accounts will result in the error.

Signs to Identify connex for QuickBooks error 3180

If you are not sure whether your application is affected by the POS error or not, then do read the below-mentioned points. These signs and symptoms will help you identify the error.

- You can not save the point of sales.

- The application shuts down suddenly.

- An error window having the message code and description will pop up on the screen.

- The system performs slowly, or it does not respond to the command.

Top Solutions to Troubleshooting QuickBooks Error 3180

Till now, we have sailed through the various causes and symptoms of the error. Now, it is high time to navigate through the multiple troubleshooting methods to remove this error from your system.

Below we have explained the different troubleshooting solutions to remove this error.

Solution 1: Merge Items in QuickBooks

Consolidating the items in QuickBooks will help eliminate duplicate items. The merging of components in QuickBooks will help in merging all the historical transactions, and you can easily view the items in a single stretch. Go with the below-mentioned traits to remove the items:

- Click on the program’s desktop icon to open the application.

- Afterward, click on the list and then pick the Item from the drop-down menu.

- Moving ahead, choose the Include Inactive option.

- Choose the Type header to sort the list and rename the point of sales items.

- After that, right, click on the payment item and choose the edit items option.

- TO rename, add the. Old to the items and tap on the “OK” button.

- Open your point of sale and run the financial exchange.

- Moving ahead, merge the duplicate items in the QuickBooks Desktop.

- In the next step, right-click on the OLD payments and choose the edit items option.

- Now, remove the Old and tap on the OK button to confirm the changes.

Solution 2: Assign vendors to Sales Tax Item

The error might appear when no vendor is linked with every Item of sales tax. If no vendor is assigned to the receipt, then the receipt is considered rejected, which will result in an error. Make sure no receipt is left without the vendor. Take the help of the below-mentioned steps to assign the vendor to the sales tax item.

- Open the QuickBooks Desktop and click on the list tab.

- Now, go to the item section and choose the include the inactive option.

- Select the Type column to sort the list.

- Make sure that all the tax items have a tax agency associated with them.

Solution 3: Recreate or Rename All Financial Methods

At certain times, the financial methods carry out bugs that result in errors. Follow the below-mentioned traits to resolve the error:

- Launch the QuickBooks desktop and go to the list menu option.

- Choose the customer and vendor profile list from the drop-down menu.

- Moving ahead, open the payment method list and double-click on the cash method.

- Now, tap on the edit payment option, and in the payment field, add the letter, X.

- Again right, click on the cash method and click on the new method.

- Lastly, rename it as cash.

Note: Repeat the above-mentioned steps will include all the payment methods.

Solution 4: Make Sure Payable Account Of Sales Tax Is Not Used To Pay Out Receipts

If you have created the paid-out with the sales tax payable account, then the POS error occurs. You can avoid such scenarios by following the below-mentioned steps:

- Open the QuickBooks POS software and navigate to the sales history.

- Now, click on any columns and pick the customize columns option from the available ones.

- Select the QuickBooks status from the customize column option.

- Look out for incomplete receipts and choose any receipt which is linked with the sales tax payable account.

- After that, click on the Reverse receipt and recreate the paid-out using the nonsales tax payable account.

- Finally, run the financial exchange.

Solution 5: Choose Tax Preferences

At certain times the chosen tax preferences are not in favor of your receipt, which will lead to the error. To remove the error, you must modify the tax preferences. Do follow the below-mentioned points to remove the error.

- Start the QuickBooks point of Sales and go to the File menu.

- After that, select the preferences tab from the drop-down menu.

- Now, pick the company and navigate to the financial section.

- Moving ahead, select the accounts and put a tick mark on the check box stating basic and advanced.

- Make sure that the QuickBooks sales tax payable is mentioned in the sales tax row. If not, alter it and run the financial exchange option.

Wind it Up

We understand that using QuickBooks is essential as it streamlines all your financial work. However, encountering technical glitches such as error 3180 QuickBooks not only hampers your productivity but also affects your work efficiency. We have summarized all the verified troubleshooting methods in the blog. We hope that these methods help you in resolving the error easily. However, in case you feel stuck anywhere in the troubleshooting process, you can seek the advice of our experts. Do not hesitate to get in touch with our experts and get your query solved. Either drop an email or a message in the chat box.

Frequently Asked Questions

Q – What are the steps to resolve the QuickBooks error code 3180?

A – There are various troubleshooting methods to deal with the QuickBooks error 3180. All the tested and verified methods are explained above. Go through the complete blog to learn the various troubleshooting methods.

Q – Can I seek help to resolve the error?

A – Yes, you can seek assistance from our experts. They are highly qualified and are trained to resolve complex QuickBooks issues. Call or email our professionals to get immediate help.

Q – Why am I unable to open QuickBooks Desktop?

A – Your QuickBooks Desktop is not opening due to various reasons. The most common reason is a corrupted or damaged company file. Get the issue fixed by implementing the troubleshooting methods.