QuickBooks Simple Start is an extraordinary accounting software that helps businesses create and handle invoices and expenses. Moreover, it is the perfect software to help run financial statements smoothly. To use this accounting software, setting it up first and then accomplishing your task is necessary. Furthermore, read the entire post attentively to get detailed information about the QuickBooks Online Simple Start application.

What are the Exclusive Features You Can Access With QuickBooks Online Simple Start?

Businesses can now pick the QuickBooks Online Simple Start application to track their income and expenses and determine the current financial status of their organization. Besides this, it also provides users with multiple top-notch features to enhance the overall accounting experience. So, let’s look at the below-mentioned feature for proper understanding.

1. Monitoring of Both Sales and Sales Tax:-

With the upcoming QuickBooks Simple Start, users can now easily accept credit cards and payments remotely. After recording the sales amount in QuickBooks, you will notice that it will compute the sales tax automatically.

2. Improve the Tax Deductions:-

Now, businesses can easily categorize business expenses into accurate tax categories. Once you categorize the transactions into the right category, analyze the proper earnings of the users.

3. Handle the 1099 Contractors:-

Form 1099 is created to report certain non-employment income with the IRS. With the QuickBooks Online Simple Start, you can stay compliant with all the laws amended by the 1099s form. Also, it lets you create and file the 1099s form right from the QuickBooks application.

4. Send the Estimates Timely:-

The users can now utilize the QuickBooks Simple Start application to generate custom and professional estimates. As a result, it will help the user convert the estimates to an invoice.

5. Easy Way of Tracking Miles:-

With the help of the GPS technology in your smartphones, you can easily track down the miles the employees have covered during working hours. As a result, it will help in computing the expenses of their business trip so that they can easily keep a record of the accounts.

6. Run the Basic Reports Smoothly:-

Users can easily run and export summary reports by accessing the Simple Start application. Also, you can run the profit and loss statement by accessing the simple interface.

7. Tracking of the Company’s Income and Expenses:-

The users can automatically categorize the transactions from the connected bank accounts. Consequently, it will help users categorize taxes accurately to compute them easily.

8. Categorizing the Receipts accurately:-

The users can use their mobile phones to take pictures of the receipts. Soon after this, the QuickBooks Simple Start will automatically organize and then tally it with the company’s expenses.

9. Prepare Invoices and Accept the Payments:-

You can now make payments faster than earlier with QuickBooks Simple Start with the credit card and bank transfers into the invoice. Apart from this, you may also customize the invoices according to your preference and brand.

What are the Advantages of Accessing the QuickBooks Simple Start?

QuickBooks Simple Start is the best accounting version, developed mainly for small-scale businesses. Moreover, using this application, users can easily send invoices to customers and link their bank and credit card accounts. Apart from this, there are several other advantages of using this application, which are listed below.

1. Easily Monitor the Check Numbers:-

The best thing about the QuickBooks Simple Start is that you can simplify your books with the ability to verify the paper check numbers.

2. Receive the Payments Quickly:-

Earlier, it took a lot of work for the users to keep in touch with the customers to collect payments, and it was also a time-consuming task. But now that you have accessed this software, you can add the payment gateway and bank transfer links directly to the invoices.

3. Tax Deduction Becomes More Convenient:-

It has become much more convenient for users to classify expenses within the right categories to reduce the tax filing process. However, it has also reduced the efforts of making mistakes while preparing the taxes. Thus, it helps in improving the tax filing process.

4. Keep track of the kilometer:-

Businesses must know the distance the sales agents travel to get the proper travel reimbursement. But now, with the help of the QuickBooks Simple Start application you can utilize the kilometer tracking tool to track down the mileage traveled. As a result, it will help keep a proper record of the business trips.

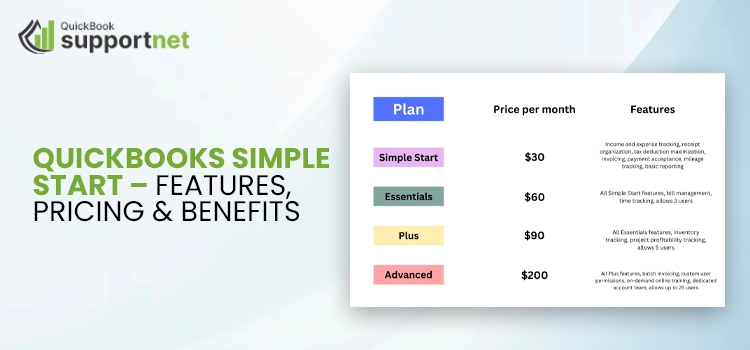

Discussing the Pricing Structure of QuickBooks Online Simple Start

The QuickBooks Online Simple Start users have to pay $15.00 monthly charge to purchase the application. Moreover, it also provides its users with a 30-day of free trial policy to test the features of the application. However, the free version will help users determine whether the application fits their business requirements and budget.

What are the Drawbacks of Using the QuickBooks Online Simple Start?

No matter how good the QuickBooks Online Simple Start application is, there are certain disadvantages to accessing it. So, to provide you with a clear vision regarding them, we have listed some of the steps below.

- The QuickBooks Simple Start application is restricted to only one single business owner.

- Another drawback of accessing it is that you can only use the software to handle certain business finances.

- Besides this, the software is best fit for only commercial purposes.

How Can You Set Up QuickBooks Simple Start Seamlessly?

It is important to set up the QuickBooks Simple Start application to use to accomplish business tasks easily. Furthermore, we have explained the proper stepwise instructions to obtain the desired results.

- To commence the process, open the QuickBooks Simple Start application and tap the Next button from the pop-up box.

- Afterwards, add the Company Name and Other crucial details properly into the required text fields.

- Thereon, opt for the desired entity form from the options available and go to the next step.

- You are supposed to mention how your company will bill its customers.

- Once you have added all the details properly, click the Next button. Apart from this, you also have to assign a new name to the QuickBooks data file.

- Your QuickBooks Simple Start setup process is now completed, and you can run the application to manage the company’s financial tasks accurately.

How Does the QuickBooks Simple Start Different From QuickBooks Essentials?

Most of the time, the users might need clarification on which one to opt for between QuickBooks Simple Start and QuickBooks Essentials as they are similar. To clarify all those doubts, we have explained them below. It will help you clearly define which one to opt for according to your business requirements.

| Basis | QuickBooks Online Simple Start | QuickBooks Essentials |

| The Simple Start application offers access to a single user with one subscription. | QuickBooks Essentials offers access to up to three users so they can work simultaneously. |

| Users should pay $15 monthly to get this accounting application. | Conversely, it is more expensive than Simple Start. You need to pay $30 monthly charge to get it on your device. |

| This accounting application only provides basic customer support options to its users. | On the other end, the QuickBooks Essentials users offer the priority support to their users along with the live chat facility. |

| It offers access to basic reports in QuickBooks only. | The QuickBooks Essential users offer in-depth financial reporting features to enhance the accounting experience. |

| The Simple Start is a great software that offers primary bookkeeping functions to enhance your accounting experience. | Similarly, the Essential. Edition also provides the bookkeeping functions. The software can also track inventory and dispatch invoices and estimates. |

Here’s How to Convert Self-Employed to Simple Start in QuickBooks

Before you convert the Self-employed to Simple Start in QuickBooks, it is advised to download all your work from QBSE. Doing so will ensure that everything is saved accurately because you don’t have to return to QBSE after converting to QuickBooks Online Simple Start.

- Begin the process by navigating to the Reports menu and then pick the tax year from the Tax Details section.

- Afterwards, choose the highlighted Download option to acquire the Tax Details section.

- Thereon, you are supposed to download the report for every tax year you have within the QuickBooks application.

- Later on, follow the instructions listed below for all the remaining reports.

Now, you are supposed to apply the instructions below to upgrade your subscription.

- First of all, hit the Gear icon and then opt for the Billing Info tab.

- Afterwards, choose the highlighted Explore QuickBooks Online plans > Switch plan or a plan option.

- You are then supposed to act according to the instructions given on the screen to move further.

- Thereon, pick the Bring my data option to select the data you desire to transfer. If you don’t wish to transfer data and begin from scratch, go with the Start Refresh option.

- In the end, hit the To QuickBooks Online option. However, if you notice the billing info review screen, click the Change Plan option to commence.

- Furthermore, you must wait for some time as the conversion process may consume some time, depending on how much data you wish to convert. Later, you will receive an email notification on the registered email address notifying you that the conversion process is completed.

Summarizing the Above!!

Through this guide’s help, we hope you have got all the important facts regarding the QuickBooks Simple Start application. However, you can contact our professionals for immediate help if you are struggling while accessing the software.

Frequently Asked Questions

Ans. The QuickBooks Online Simple Start usually provides several discounts for the new users. You can get a 30-day free trial to access this accounting software on your device.

Ans. Below, we have mentioned the reports you can include along with the QuickBooks Simple Start.

1. Balance Sheet

2. Total income of P& L statement

3. Comparison of the Profit and Loss account

4. Profit and Loss By Customers

5. Audit Log

Ans. You can send an invitation to the accountant and access the QuickBooks Online Simple Start. Thereon, you must hit the Gear icon > Manage Users > and accurately include the accountant’s ID in the search column. Later on, hit the Invite tab and then the Save button to complete the process.

Ans. No, the Accounts Payable isn’t included in the QuickBooks Simple Start application. Even if this application allows you to track costs, you must require QBO Essentials to monitor and pay bills.

Ans. Of course, you have the option to switch to any updated version of QuickBooks and carry on to complete the financial task.