Form 941 is one of the most important IRS forms that is used by businesses for reporting employment taxes. It also reports federal income tax withholding, Social Security tax, medical care, and other medical taxes. For filing the form, you can also use the QuickBooks application once you create yourself as a Reporting agent and are authorized to e-file returns....Read more

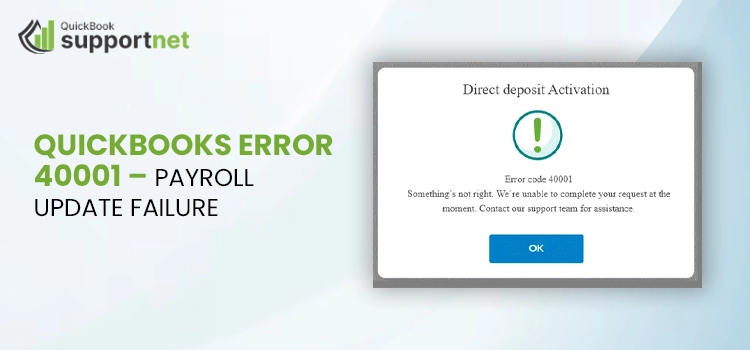

QuickBooks Payroll provides its users with a direct deposit feature to pay their employees directly into their bank accounts. Moreover, this feature streamlines the payroll-related tasks and minimizes the issues occur while preparing checks. However, sometimes users come across QuickBooks Error 40001 when activating direct deposits. At times, this issue may strike due to improper network connectivity or incompatible software...Read more

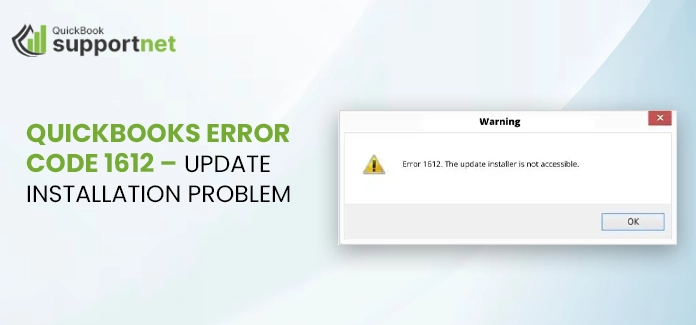

QuickBooks Error 1612 is an error that occurs in your System due to an interruption in the installation of the QuickBooks Software. However, the steps to rectify this Error are not so difficult if you know the set of steps. Thus, if you are also facing this Error, and don't know how to resolve it, simply read this blog and...Read more

QuickBooks error code 7300 can take place when setting up the program or during the Windows startup or shutdown. Besides you may also see this error code during the installation of the Windows operating system. When the error occurs, you may not be able to open your company data. Also, you may not be able to run the program at...Read more

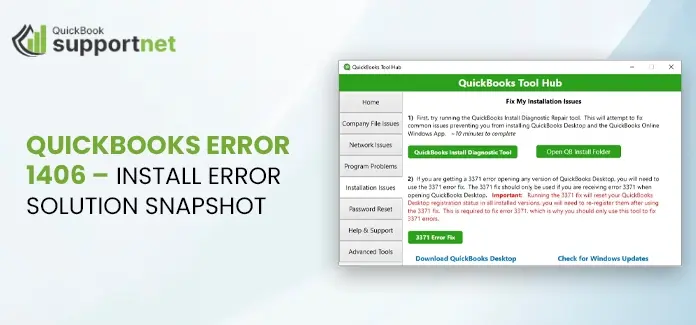

QuickBooks Error 1406 occurs when the software fails to write certain registry entries during installation or updates. This issue is usually caused by permission restrictions, outdated system settings, or interference from third-party applications like antivirus software. As a result, users may face installation failures or software malfunctions that prevent QuickBooks from running smoothly. Resolving this error involves running QuickBooks as...Read more

When working with QuickBooks, users may encounter various technical issues that disrupt their workflow. One such issue is the QuickBooks compile error in hidden module, which typically occurs when integrating QuickBooks with Microsoft Office applications like Excel or Word. This error is often linked to compatibility issues, missing or damaged components, or outdated software versions. If left unresolved, it can...Read more

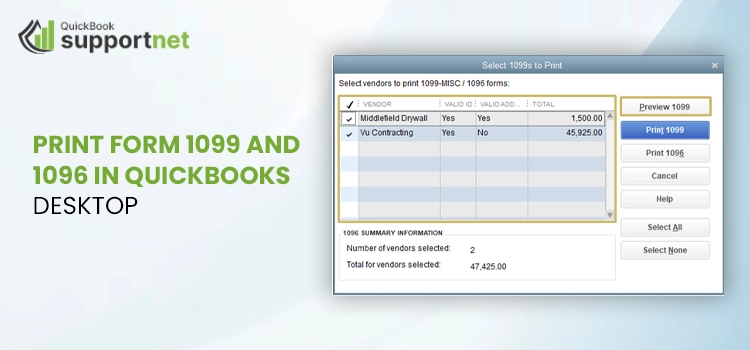

Tax season can be overwhelming, and we know how crucial it is to get everything right without errors. If you’re using QuickBooks Desktop, printing Forms 1099 and 1096 is simple and hassle-free. These forms are essential for accurately reporting business income, so managing and printing them correctly is a must. If you're looking for a step-by-step guide on how to...Read more

QuickBooks Online is a powerful cloud-based accounting solution designed for seamless collaboration, allowing multiple users to access and manage the same company file in real time. With its advanced features, QuickBooks Online simplifies accounting tasks, making financial management more efficient. However, migrating data from QuickBooks Desktop to QuickBooks Online can seem complex. If you're considering making the switch, this guide...Read more

Users often stumble upon QuickBooks Payroll Error Code 15218 while installing the latest payroll updates. Wondering why it happened? It might take place due to the incorrect configuration of Internet Explorer. Other reasons that might end up with this error are using outdated QBDT, and damaged .ND file or using a poor internet connection. Whenever the error occurs, it interrupts...Read more

Many times, users might come across tab key is not working in QuickBooks error when there are some issues with the keyboard itself. In other instances, it might also evoke when the tab feature in QuickBooks is damaged. Therefore, it is essential to use the correct troubleshooting methods to rectify the error. Continue reading this entire post to know the...Read more