Employers provide the W-2 and W-3 forms to individual employees, detailing overall income, deductions, taxes, and other important information. Accurate completion of these tax forms ensures the proper administration of payroll and tax systems for both employers and employees.

QuickBooks allows you to file both forms in all versions and easily print copies to share with your employees and the relevant administration.

In this guide, we will explore the importance of these forms, provide instructions on how to file them correctly, and offer step-by-step guidance on printing your W-2 and W-3 forms in QuickBooks. Let’s get started with this comprehensive guide.

An Overview of Tax Form W-2 and W-3 Forms

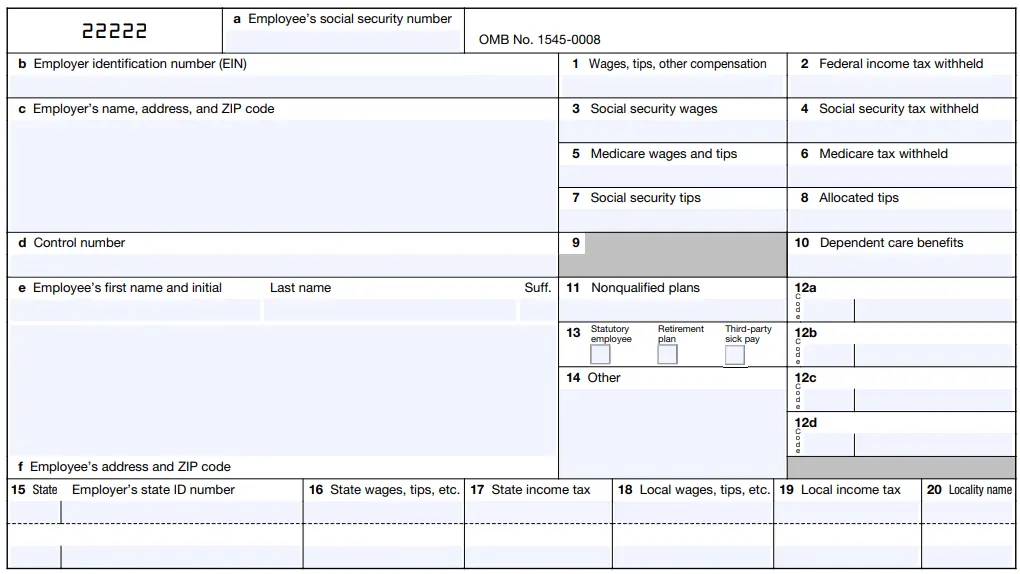

The W2 form is a Wage and Tax Statement issued by the employer to an employee at the end of the year. It states the total wages earned for the year, tax deductions, and other deductions from the paycheck. Issuing the W-2 form is important, as it enables employees to file their personal income tax return.

On the other hand, the W-3 form is a Transmittal of Wage and Tax Statements that is submitted by an employer to the Social Security Administration (SSA) and the Internal Revenue Service (IRS).

This tax form includes a summary of all the W-2 forms that the employer has issued to their employees. The W-3 form is important because it allows the SSA and the IRS to verify the information on the W-2 forms and ensure that taxes have been reported correctly.

Learn More – How to E-file QuickBooks Form 941

Learn How to Print Your W-2 and W-3 Forms in QuickBooks

Whether you use QuickBooks Desktop, Online, or a separate Payroll subscription, the following steps will guide you through printing the W-2 and W-3 tax forms. Continue below to share the tax details with your employees:

1. Buy W-2 paper (if applicable)

If your employee lost their tax form or didn’t get their original W-2 or W-3, you will need a copy of your records. Use the pain paper to take a printed copy, as in Step 2.

If you are printing and emailing official copies of W-2s to your employees from QuickBooks, consider purchasing W-2 paper to ensure accuracy and compliance with tax regulations. We recommend ordering W-2 kits (including W-2s and envelopes) through us to ensure the W-2s print correctly.

- Visit QuickBooks Checks & Supplies.

- Click on Tax Products.

- Select Blank W-2 kits.

- Follow the steps on your screen to finish the order.

- If you use QuickBooks Online Payroll or QuickBooks Desktop Payroll Enhanced or Standard, get 3- or 4-part perforated paper.

- If you use QuickBooks Desktop Payroll Assisted, you’ll only get 4-part perforated paper.

Read More – Print Form 1099 and 1096 in QuickBooks Desktop

2. Print your W-2 and W-3

Print your W-2 and W-3 forms in QuickBooks Desktop in different versions:

a. QuickBooks Online Payroll

You can print your W-2 and W-3 forms in QuickBooks Online on the same date or after:

- January 1, if your automated taxes and forms settings are OFF

- January 15, if your automated taxes and forms setting is ON

Note: If you opt to mail W-2s to your employees, they’ll be sent to the mailing address listed in the employee profile.

Print current year or 1 year prior

Follow this link to complete the steps in the product.

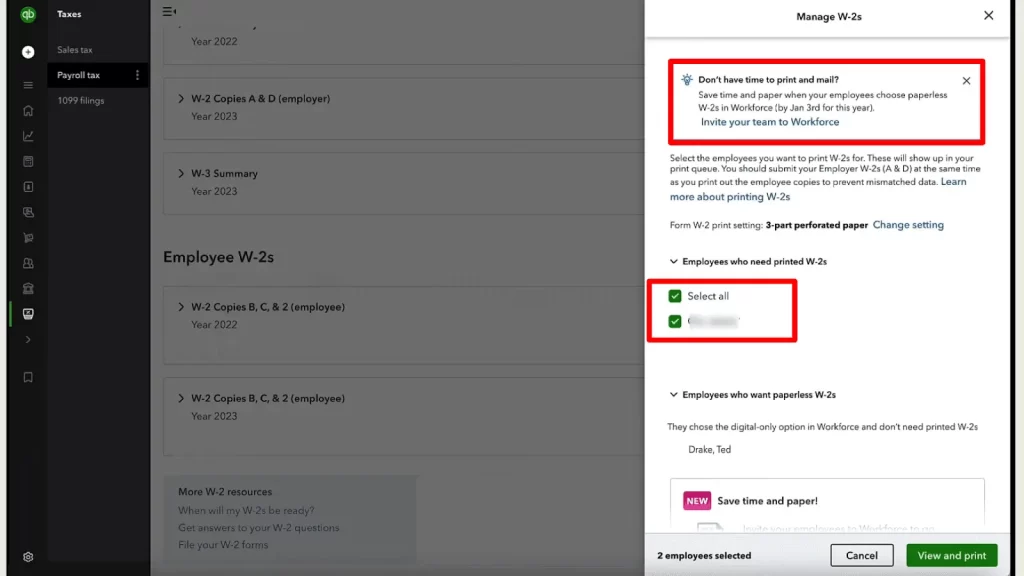

- Go to Filings.

- Select Resources > W-2s.

- Review the list of employees you are printing the tax form for.

- Employees who chose paperless will not have W-2s printed. They can print their copy from QuickBooks Workforce if necessary.

- If your automated taxes and forms settings are off, check your Form W-2 print setting. Select Change setting to adjust the paper type if needed.

- Hit on View or Manage the copy you are printing:

- W-3 Summary Transmittal of Wage and Tax Statements

- W-2, Copies B, C & 2 (employee)

- W-2, Copies A & D (employer)

- Click on View and print.

- Choose the Print icon on the Adobe Reader toolbar. Then, select Print.

Note: When reprinting for a lost or not-received W-2, write REISSUED STATEMENT at the top and include a copy of the W-2 instructions.

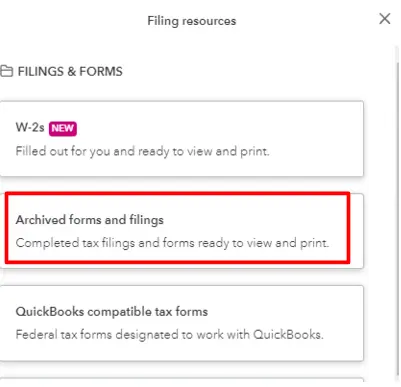

Print previous years

Follow this link to complete the steps in the product.

- Go to Fillings.

- Select Resources.

- Hit on Archived forms and filings.

- Select the date range for which you are printing the form. You can also simply search for the forms you need.

- Hit View on the W-2 or W-3 form you wish to print.

- On the Reader toolbar, hit the print icon.

- Select Print again.

The layout of QuickBooks may be updated, so we recommend consulting with QuickBooks or an accounting expert at +1(866)500-0076.

Also See – How to print w2 form in QuickBooks

b. QuickBooks Desktop Payroll Assisted

W-2 forms will be available to print starting January 10. If you’re choosing Intuit Print, you’ll only need to print your W-2 forms if your employee has lost or not received their original W-2 form.

- Go to Employees.

- Select Payroll Center

- Navigate to the File Forms tab.

- Choose View/Print Forms & W-2s.

- Enter the payroll PIN and click OK.

- Move to the W-2s tab.

- Choose the year, then all or individual employees.

- Hit the Open/Save Selected button.

- Select the appropriate reason for which you are printing the W-2.

- Click on File in Adobe Reader and select Print.

Note: If your employees lost their W-2 or didn’t get the original tax form, write REISSUED STATEMENT at the top to re-print and include a copy of the W-2 instructions.

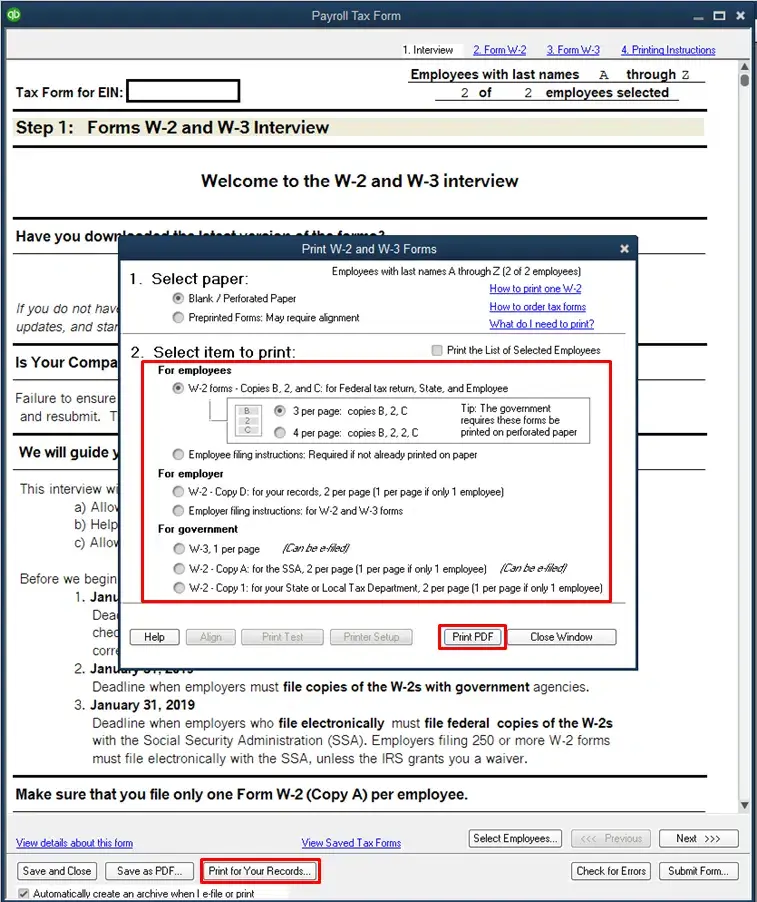

c. QuickBooks Desktop Payroll Enhanced and QuickBooks Desktop Payroll Standard

Your W-2s will be available for printing after January 1.

- Update QuickBooks Desktop and payroll services.

- Go to the Employees menu.

- Select Payroll Tax Forms & W-2s, then Process Payroll Forms.

- In the File Forms tab, move down and choose Annual Form W-2/W-3 – Wage and Tax Statement/ Transmittal.

- Click on Create Form.

- Either choose all or individual employees to file.

- Enter the year to see the form and click OK.

- Select all or individual employees to print the documents.

- Click on Review/Edit to review each W-2.

- You will see the reviewed W-2s have a checkmark in the Reviewed column.

- When done, choose Submit Form and follow the steps on your screen to print and file the forms.

Note: If your employees lost their W-2 or didn’t get the original tax form, write REISSUED STATEMENT at the top to re-print and include a copy of the W-2 instructions.

Conclusion

A printed copy of the W-2 and W-3 tax forms allows businesses to share them with their employees in case they have lost or require a physical copy, as well as for record-keeping purposes. The above steps outline how to print your W-2 and W-3 forms in QuickBooks.

For further assistance, we recommend consulting with QuickBooks professionals at +1(866)500-0076. Speak with an expert and consult with us now!

Frequently Asked Questions

How to print W-2 and W-3 in QuickBooks Online?

Here’s how to print W-2 and W-3 in QuickBooks Online:

- Go to Fillings.

- Select Resources > W-2s.

- Now, follow the on-screen steps.

- Select the steps according to your preference.

- Hit on View and print.

- Hit the Print icon on the Adobe Reader toolbar.

- Finally, click Print.

Where to find W-2 forms on QuickBooks Desktop?

There are two ways to find W-2 forms in QuickBooks Desktop: either through the QuickBooks Workforce app or the web version. Check these steps for the app:

- Go to Taxes or More.

- Select W-2s.

- Click Download.

- Choose the W-2 you want to view or print.

How to export W-2 from QuickBooks to Excel?

Here’s how you can export W-2 from QuickBooks to Excel:

- Open this in a new window.

- Look for the report you wish to export.

- Under Export/Print drop-down, choose Export to Excel.

- Save the file in the Download folder or your desktop.

Where to find W3 in QuickBooks Online?

Find your W3 in QuickBooks Online:

- Go to Taxes > Payroll Tax.

- Go to the Forms section > Annual Forms.

Choose W-3, and then View.