At the end of the financial year, every employee receives the Print W-2 Forms in QuickBooks from their employer. The form plays an important role in filing the tax as it contains sensitive information related to the employee’s salaries, tax deductions, withholdings, insurance, personal information, and much more. The form is issued by the employer, who holds the different copies of the form and sends the copies to the federal government, employees, and the state government. No matter what position you hold or where you work, the form is needed by everyone.

Apart from the advanced accounting features, QuickBooks has some amazing add-ons which allow you to generate CRMs, automate payrolls, record bank transactions, and roll out taxes. QuickBooks online allows you to comprehend payroll and generate W2 forms easily. If you are looking for a complete guide that explains the process of printing w-2 forms in QuickBooks, then this piece of content is for you. So, deep dive into the pool of knowledge and know the method in a simple manner.

What is a W-2 form in QuickBooks Desktop?

Every citizen must pay taxes to the government for the development of the country. Calculating the payable taxes is a tedious task that involves a lot of calculations. However, if you are an employee, then you do not need to worry about paying taxes, As your employer already deducts the tax from your salary. To know the exact details about the deductions, the employee needs the Print W-2 Forms in QuickBooks .It is a legal document that an employer is required to deliver to each of its employees as well as the Internal Revenue Service (IRS). It is also known as the Wages and tax statement form.

The form indicates that the tax of the employee is deducted from his salary by his employer, and he submits the information to the government.

Importance of Print W-2 Forms in QuickBooks

The employer must send the W-2 form to every employee at the end of the year, along with the pay slip. As the taxes are deducted from your salary at the end of every month and are transferred to the IRS, the W-2 form calculates the accurate amount that has been assimilated as a tax. Without the W2 form, you would not be able to file the tax accurately at the end of the financial year. And an inaccurately filed tax will further delay receiving the tax return amount from the government.

Things to Consider Before and After printing w-2 Forms in QuickBooks

Below we have mentioned the three necessary things that the users must keep in mind while Print W-2 Forms in QuickBooks form:

Save the W2 form draft.

By clicking on the save as a PDF option, you can save the draft of the W2 form in the payroll tax form window. You can easily find the button at the bottom of the screen.

Automatic Archives of W 2 Form in QuickBooks

The form is automatically archived when the e-filing or the print box is chosen. In the Payroll tax window, you can easily locate the option at the bottom left side. The form is automatically saved in the PDF format at the default location.

Access Archived Forms When no active Payroll subscription is there

You can access the form even if you do not have an active payroll subscription. Without opening the QuickBooks program, search the archived W2 forms in the system. Usually, you can find the file at C:\Users\PublicDocuments\Intuit\QuickBooks\Sample Company File\QuickBooks XXXX(Write Company name)\ Tax Form History. Pick the folder having the archived form. The folder includes the 941 W2 in its name.

Requirements for printing w-2 forms in QuickBooks

If you are an employer, you can easily generate and print the W2 form for your employees with the help of QuickBooks online. However, before knowing the method to print w-2 forms in QuickBooks, you must know the basic prerequisites that will help you in the further printing process.

Below we have mentioned the basic requirements which are required at the time of printing the form.

- Ink: To print the form, black color ink is mandatory.

- Paper: Ensure that the paper is in good condition and is spotless.

- Printer: Ensure that the printer is configured properly and is in working condition.

- Subscription: Make sure that you have an active subscription to QuickBooks Payroll. Also, double-check if their payroll is compatible with the W2 forms.

- Local taxes: Make sure that you are using the updated and the latest tax table in QuickBooks.

Verify the QuickBooks Payroll Service You are using.

It is essential to know the QuickBooks payroll service version which you are using before printing the form. The steps to print the form might slightly differ in different versions. If you are not aware of the Payroll version, then, do follow the below-mentioned steps:

- Log in to QuickBooks and go to the settings tab.

- Under the settings tab, select the accounts and settings option.

- Moving forward, pick the billing subscription and payroll options.

- After that, tap on the plan details to know the current plan you are using.

- If it shows enhanced or basic, then it indicates the QuickBooks self-service payroll.

- However, if it shows the full-service payroll, then you are using the full-service payroll version.

Basic Steps to print w2 form in QuickBooks

Once you have fulfilled the basic requirement for printing w-2 forms in QuickBooks, now, it is the right time to know the printing steps in detail. The basic steps are as follows:

Step 1: Open the W 2 Forms in QuickBooks Desktop

To open the forms, follow the below-mentioned steps:

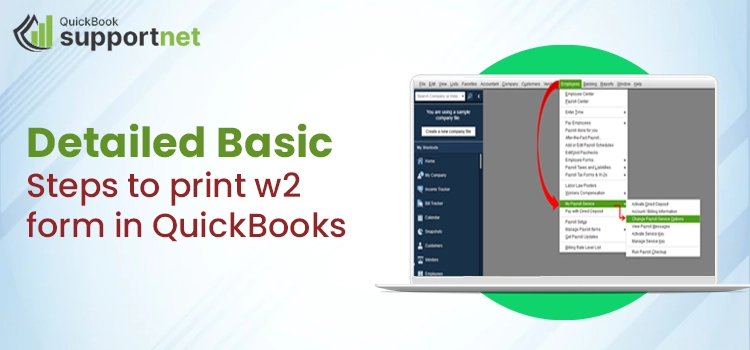

- Open the QuickBooks and click on the Employees menu tab.

- Choose “payroll tax forms and W 2s” option from the available options in the drop-down menu..

- Moving further, select the “process payroll forms” option from the drop-down menu.

- After that, select the tax statement transmittal and annual Form W2/W3 wage option.

- You can create the form by clicking on the create form tab.

- If you want to fill out the form for all your employees, then tap on the “All Employees” option.

- Make sure that you tap on the last name of the employees.

- After that, add the year of the form you want to print.

- Moving ahead, press the “OK” button.

Note: Only one version of the tax form is saved. In case you need to print the tax form for another year, you will require a newer version of the form to use.

- For printing the form, select the employees. In case you want to review or edit your W2 form, you need to click on the review/edit button.

- Click on the submission form button to continue the printing process.

- Lastly, click on the print/e – file option.

Step 2: Select the type of the paper

You can select the type of paper to print the form. You can select paper like perforated paper/blank or preprinted forms. After that, choose for whom you want to print under the item to print section.

For Employer

- For your records W-2 – Copy D, 2/page.

- W-2 and W-3 form filing instructions for the employer.

For Employees

If you’re using perforated/blank paper

- 4/page: copies B, 2, 2, C

- 3/page: copies B, 2, C

- Instructions for filing by employees: required if not already printed on paper

For Government

- W-2, copy A (SSA), page two

- For the Department of State or Local Tax, W-2 Copy 1 is a two-page document.

- W-3/page.

If you’re using preprinted forms

- For your State or Local Tax Department, copy 2 of the W-2, 2 pages.

- W-2 – Copy B: For an employee’s two-page annual tax return.

- W-2 – Copy C: records for an employee, 2/page.

- Necessary Instructions helpful in Employee filing: if not already printed on paper.

Step 3: Export the W2 forms and Start Printing

Follow the below-mentioned steps:

- If you are using the preprinted forms, then you are advised to perform a printing test.

- Click on the print button and print the PDF.

Winding it Up

W 2 forms play an important role in filing accurate taxes. It is legal to distribute the form to every employee who receives the salary or other compensation from the employer. The hard copies of W2 forms help you. However, to distribute the hard copies, you need to print the form. We hope that the above-mentioned procedure helps you in Print W-2 Forms in QuickBooks. In case you are stuck anywhere in the process, you can get assistance from our experts. Our team of highly professional experts is available for you 24 X 7. Drop an email or message in the chat box, or talk to them over the phone to get the proper assistance.

Frequently Asked Questions

Q – Can we use plain paper to print the W2 form?

A – You can print the form either on perforated paper or blank paper to print the form in QuickBooks.

Q – Can I report an employer if he has not sent the W2 form?

A – As W 2 form is essential, the employer must send it to the employees without failing. However, if he has not sent the form, you can contact the employer and ask him to send the form. However, if you still not receive the form, you can contact the IRS and report the employer.

Q – Does QuickBooks send the W-2 forms?

A – Yes, QuickBooks send you the W2 form in a secured Window envelope which is pressure sealed.

Q – How can I create a W2 form in QuickBooks Desktop?

A – Follow the below-mentioned steps to create the form in QuickBooks Desktop

- Open the company file in QuickBooks Desktop.

- Now, click on the reports menu and pick the employees and payroll option from the available options.

- After that, click on More payroll reports in the Excel option.

- Moving ahead, select the tax form worksheet option and enable it in the Excel window.

- Choose the annual W 2/W 3 and the period date.

- Lastly, click on the create report tab.

Recommended Post:-