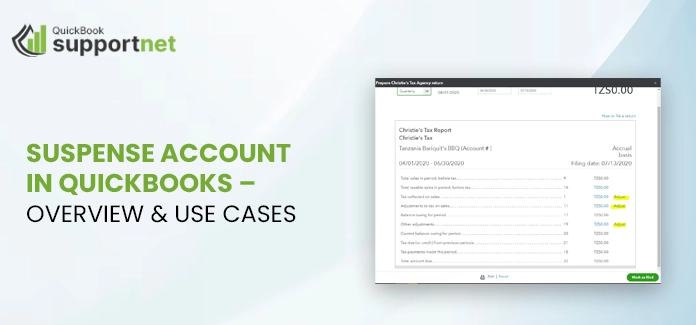

In QuickBooks Online, the main purpose of creating a suspense account is to document unfamiliar transactions or entries. This is usually a temporary account that helps to store the transactions until the correct accounts are identified. The suspense account entries will be immediately moved to the designated accounts as soon as the account is identified. Consequently, it guarantees that your...Read more

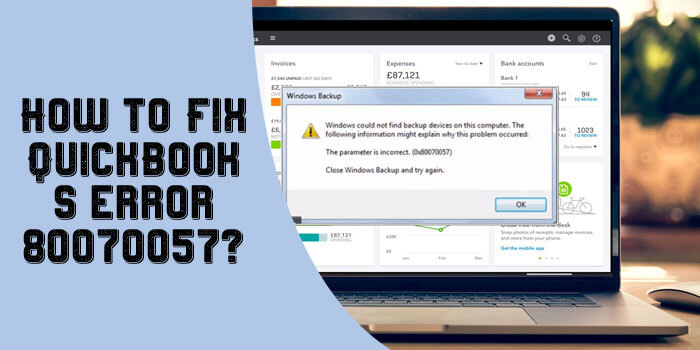

Are you having trouble accessing the data file due to QuickBooks Error 80070057? If yes, it usually occurs when the users don’t have proper administrative rights to operate the software. Other reasons may be incorrect company file location, damaged data file path, or internet-related issues. However, it is crucial to resolve this issue quickly so that you can regain access...Read more

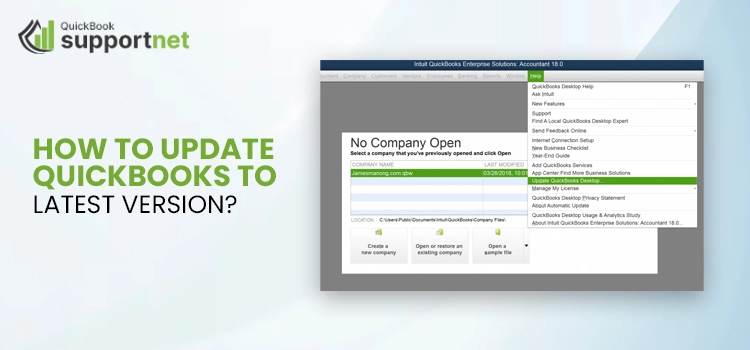

Software updates are essential to ensure you have the latest features and security patches, to ensure better performance and seamless work experience while managing your business accounting and finances. As a payroll user, updating the payroll tax table is important to ensure your tax rates are up to date for accurate tax calculations and compliance. If you are also wondering...Read more

For the daily QuickBooks users, one of the most annoying issues is the QuickBooks Desktop won't open error. While working on the software, if it suddenly crashes, stops working, or won't even open, it can significantly hamper your workflow and overall productivity. This issue could be a result of an outdated operating system, a corrupt hard disk, or a damaged...Read more

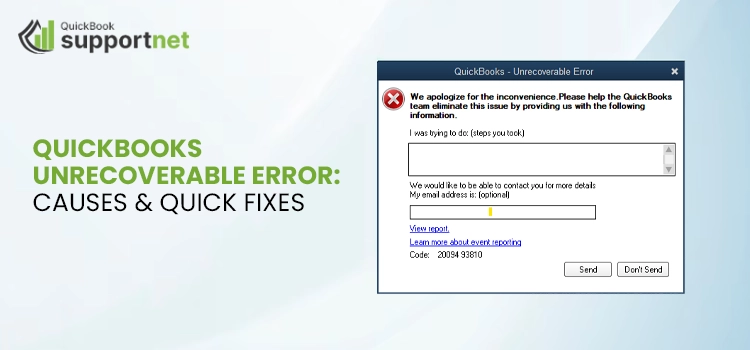

QuickBooks Unrecoverable error is the most common issue that many users might confront while performing different tasks. It might appear while opening the company file, emailing, printing, saving files as PDFs and importing the Accountant's changes. Sometimes, this issue may also trigger while reconciling or running the rebuild utility. Most often, this issue appears because of damaged data or missing...Read more

Intuit has officially announced the discontinuation of QuickBooks Desktop 2021. All versions of QuickBooks 2021, including Pro, Premier, Enterprise V21, and QuickBooks Desktop 2021 for Mac will be discontinued after May 31, 2024. However, there is no surprise about it, as Intuit retires an older version of the product every year. If you are using also using QuickBooks 2021, then...Read more

In this fast-paced, competitive environment, most organizations prefer to work remotely instead of coming to the office. With QuickBooks Desktop Cloud Hosting, working from anywhere and anytime through any device has become possible. To run this cloud hosting service, you only require a good and stable internet connection to stay connected with your team members seamlessly. Continue reading this post...Read more

QuickBooks is a popular accounting software with numerous functionalities and tools to use and manage your daily business chores. But what if it's not properly activated or registration errors in QuickBooks desktop? Problematic, right? To access the QuickBooks excellent utilities and features, make sure to register the software properly, or else you may come across the registration error in QuickBooks...Read more

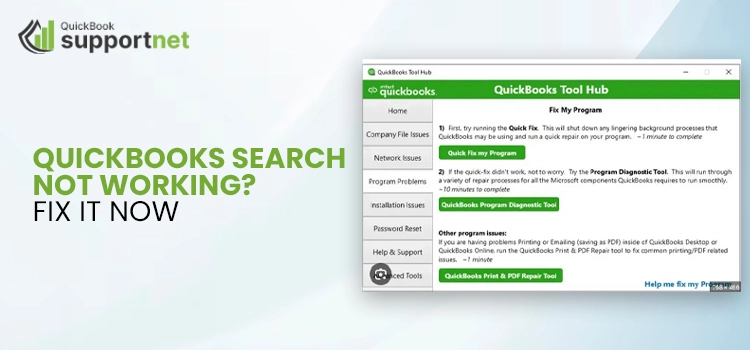

An advanced feature has been added to QuickBooks, which is QuickBooks search. This tool impressively helps users find any specific data related to their business, including employee payout, vendor's list, employee name, etc. However, a lot of users have complained about this feature due to its malfunctioning and other technical issues. Are you also among those users coming across the...Read more

QuickBooks error 2000 is an external error, and it occurs due to network or server issues. This error can take place when you are using the banking feature from within the QuickBooks application. It is also possible that you haven’t set the banking accurately. However, there are several other reasons as well that can give rise to error 2000 in...Read more