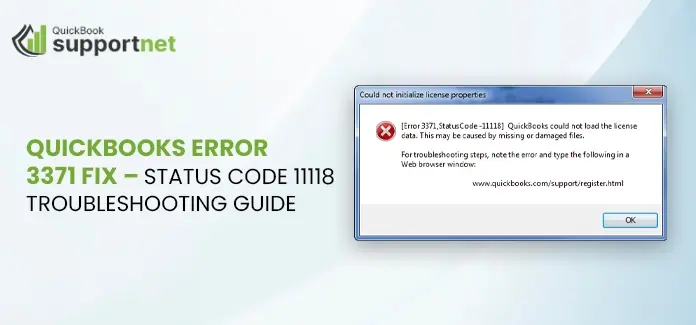

Are you stuck with QuickBooks error 3371 Status Code 11118 while activating or opening QuickBooks Desktop? Thinking, what is the reason behind this? It might happen due to the missing QBregistration.dat file. Other reasons that might evoke this error are misconfigured internet connection, a damaged MSXML component, and an outdated Windows operating system. Every time the error occurs, it throws any...Read more

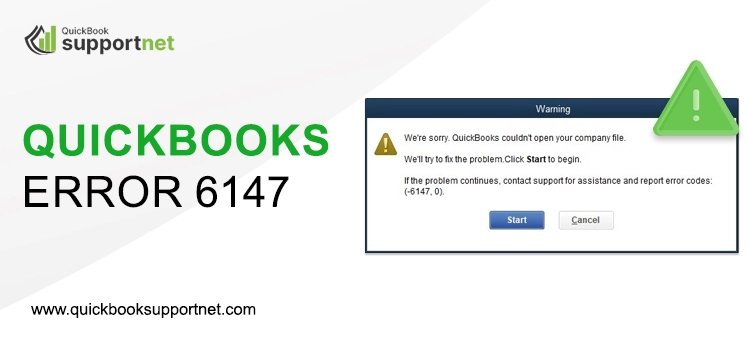

Confronting the annoying technical issues while running the highly recommended accounting application might be problematic for the users as it may hamper their workflow. Similarly, users might get frustrated when they stumbled upon QuickBooks Error 6147 while trying to open their company or backup files. Usually, the users often confront this common company file error due to the damaged file...Read more

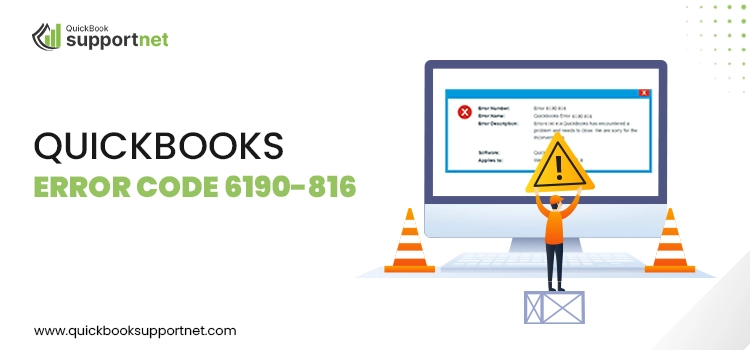

QuickBooks Error 6190 816 is a common issue that occurs when users try to open a company file in a multi-user environment. This error usually appears when the company file and the transaction log file don’t match or when another user is accessing the file in single-user mode. It can disrupt workflow and prevent access to important accounting data. Luckily,...Read more

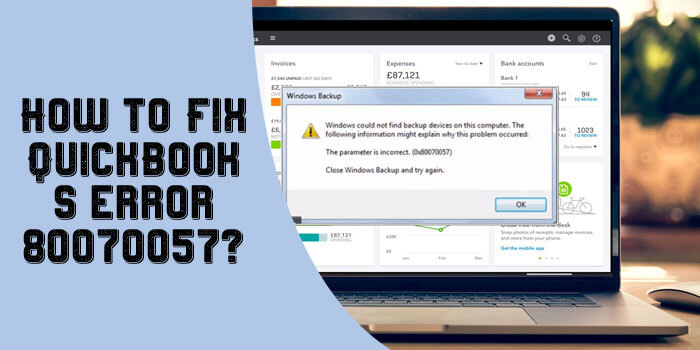

Are you having trouble accessing the data file due to QuickBooks Error 80070057? If yes, it usually occurs when the users don’t have proper administrative rights to operate the software. Other reasons may be incorrect company file location, damaged data file path, or internet-related issues. However, it is crucial to resolve this issue quickly so that you can regain access...Read more

When working with QuickBooks, users may encounter various technical issues that disrupt their workflow. One such issue is the QuickBooks compile error in hidden module, which typically occurs when integrating QuickBooks with Microsoft Office applications like Excel or Word. This error is often linked to compatibility issues, missing or damaged components, or outdated software versions. If left unresolved, it can...Read more

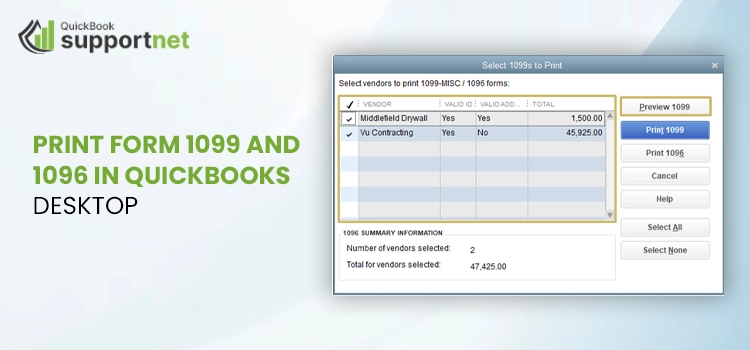

Tax season can be overwhelming, and we know how crucial it is to get everything right without errors. If you’re using QuickBooks Desktop, printing Forms 1099 and 1096 is simple and hassle-free. These forms are essential for accurately reporting business income, so managing and printing them correctly is a must. If you're looking for a step-by-step guide on how to...Read more

There's nothing more frustrating than dealing with a technical glitch while managing payroll and employee payments. QuickBooks Error PS038 is one such issue, often caused by an outdated payroll application. While updating the software can usually fix it, if the problem persists, keep reading to discover other potential causes and solutions In this blog, we explore various factors that can...Read more

QuickBooks Error 15103 is part of the 15XXX error series that can disrupt your workflow. This error typically occurs when you're trying to download a QuickBooks Payroll update, but the process fails. QuickBooks Payroll is a subscription-based service designed to help users manage employee payroll efficiently. However, when this error pops up unexpectedly, it can prevent you from completing important...Read more

QuickBooks Online is a powerful cloud-based accounting solution designed for seamless collaboration, allowing multiple users to access and manage the same company file in real time. With its advanced features, QuickBooks Online simplifies accounting tasks, making financial management more efficient. However, migrating data from QuickBooks Desktop to QuickBooks Online can seem complex. If you're considering making the switch, this guide...Read more

Users often stumble upon QuickBooks Payroll Error Code 15218 while installing the latest payroll updates. Wondering why it happened? It might take place due to the incorrect configuration of Internet Explorer. Other reasons that might end up with this error are using outdated QBDT, and damaged .ND file or using a poor internet connection. Whenever the error occurs, it interrupts...Read more