Many times, users might come across tab key is not working in QuickBooks error when there are some issues with the keyboard itself. In other instances, it might also evoke when the tab feature in QuickBooks is damaged. Therefore, it is essential to use the correct troubleshooting methods to rectify the error. Continue reading this entire post to know the...Read more

Many times, users might come across QuickBooks cannot communicate with the company file error due to restrictive firewall settings. In other instances, it may occur when QBDBMgrN is not running in the background. Whenever the error triggers, the following error message reflects on your computer screen stating: However, it is essential to get rid of QuickBooks fails to communicate with...Read more

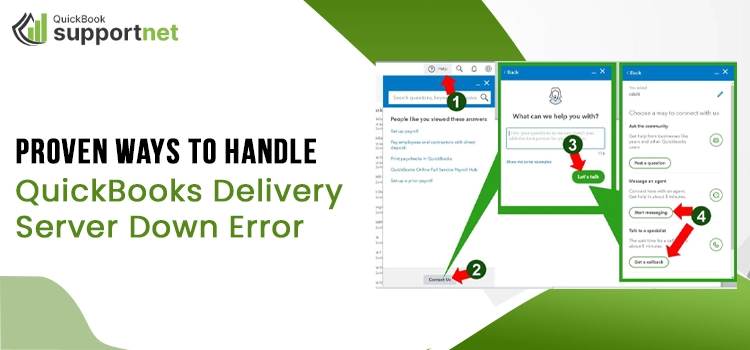

QuickBooks is an Avant grade accounting software that has revolutionized the financial world. No wonder the software is used by millions of people across the globe to streamline their accounting tasks. However, despite being a reliable accounting software, it is exposed to various technical bugs and glitches. One such issue that most of the users face while exploring the application...Read more

QuickBooks is a leading accounting software designed to streamline transactions, invoicing, billing, tax management, and payroll for millions of users worldwide. Widely used by small to medium-sized businesses, it helps manage financial records efficiently. However, users may sometimes encounter issues when printing, emailing, or saving PDFs in QuickBooks. If you're facing a "QuickBooks Unable to Create PDF" error, this guide...Read more

Today, many businesses rely on payroll software to manage payroll tasks efficiently rather than handling them manually. QuickBooks Payroll is a popular choice, ensuring seamless payroll processing in line with the latest tax tables. However, users often encounter QuickBooks Error PS032 when attempting to download the latest payroll update. This issue typically arises due to an inactive payroll service subscription....Read more

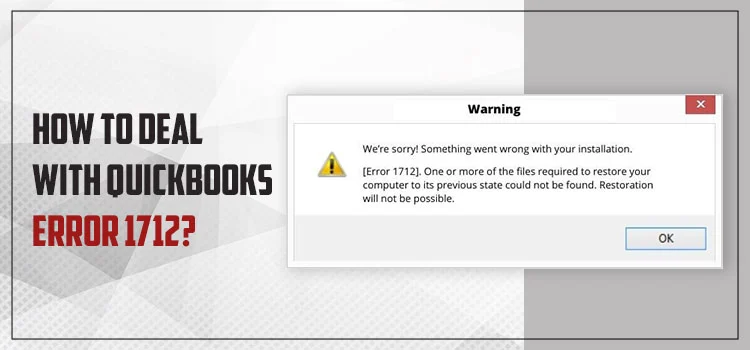

After a few recent QuickBooks updates, QuickBooks users are facing issues, including QuickBooks error 1712 while opening and reinstalling the QuickBooks software. Are you among those QuickBooks users as well? If yes, you are not alone in this; we have prepared this comprehensive blog with the most reliable and quick troubleshooting solutions to fix the problem. Continue reading! Facing QuickBooks...Read more

QuickBooks provides its users with an option using which they can delete an account in QuickBooks Online if it is not in use anymore. However, if you wish to restore the account you previously deleted, you have to make it active again. To know proper instructions regarding how to delete and restore an account in QuickBooks Online, continue reading this...Read more

QuickBooks installation gets damaged when incompatible settings or components are used to carry out the process. Intuit has a special tool for to repair the damaged program installation - QuickBooks Install Diagnostic Tool. This tool fixes the damaged components, such as .NET Framework, MSXML, and C++. Thus, you can install QuickBooks without experiencing any error or technical hurdle. However, many...Read more

Run into trouble when installing QuickBooks Desktop, or did you fail to open the program after installing it and encounter QuickBooks error 1603? Regardless of the situation, the issue can prevent you from getting started with QuickBooks's accounting and payroll management. You may get a warning message on the screen with error code 1603 that reads "Error 1603: There was...Read more

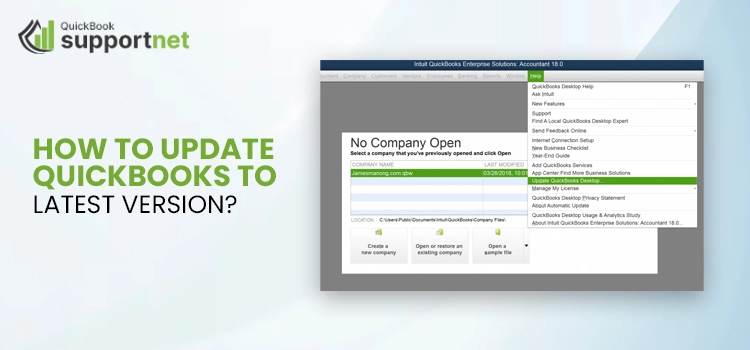

Software updates are essential to ensure you have the latest features and security patches, to ensure better performance and seamless work experience while managing your business accounting and finances. As a payroll user, updating the payroll tax table is important to ensure your tax rates are up to date for accurate tax calculations and compliance. If you are also wondering...Read more