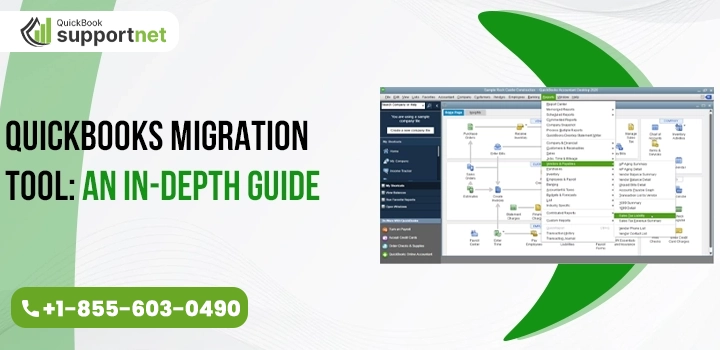

Your financial data is one of the most important assets of your business, which helps you get crucial insights and answer the most perplexing questions. If you are using the QuickBooks application, you are blessed with the QuickBooks Migration Tool & Data to move your data from one version of the program to another. Thus, you can run your program and business as per your varying requirements. However, not all users find it easy to run this tool to migrate their financial data. Therefore, this post answers various queries related to the tool so that you can utilize it easily and grow your business. Let’s start.

Are you unable to use the QuickBooks Migrator tool? Do not worry. Just Speak to Our nerds @ +1855-603-0490 and know the most suitable process in easy language.

If you, too, are in the same situation, then do not panic. This blog explains the purpose of the tool and the process of transferring the data via the migrator tool. So, read the complete blog carefully.

About QuickBooks Migration Tool – What Does It Do?

QuickBooks Data Migration Tool is an important utility that comes in handy when you need to move your financial data from one version to another version. Besides, it is also helpful when you need to move your data from one device to another. Performing this task manually can take plenty of your time and evokes the scope for errors.

On the contrary, this tool can migrate your crucial QuickBooks data in significantly less time. Moreover, the automated data migration lets you avoid key-punching and other human errors. QuickBooks Desktop 2024 Data Migrator has two different versions. One works for QuickBooks Pro, Premier, and Mac, while the other is suitable for the Enterprise version.

Before You Move Your QuickBooks Data – Important Considerations

Now that you know a bit about the QuickBooks Data Migration Tool make sure that this migration is right for you. Migrating data can be a demanding task, and therefore, don’t move ahead until you are double sure about the process. You can break down this task into two steps:

1: Understanding Your Business Requirements

In the first place, you need to take a deep dive into your business accounting processes to understand them. Thus, you can also get to learn what needs to be covered in the program you are converting your data into. For instance, if you need powerful accounting features, QuickBooks Desktop can be the ideal choice for you. However, if you need flexibility in your business accounting management and promote collaboration among the stakeholders, QuickBooks Online has got you covered. Once you are clear with your requirements, you can think of carrying out the migration process.

Besides, the size of the company file is also one of the crucial factors that need to be considered during the migration. A company file is where your business information is stored. If you are migrating your data to QuickBooks Online, you need to understand that not all the data is moved. Moreover, for larger file migrations, you may need additional configurations to be enabled.

2: Comparing Features Of The Two Different Versions

After analyzing your business requirements, you need to compare the features of your legacy accounting system with the latter one. Also, you need to understand how the information migrated to a new version of the program will be handled. QuickBooks Data Migration Tool has certain limitations and does not move all your financial data.

You will have to move the remaining data manually from the QuickBooks application. QuickBooks offers many different versions of Desktop and Online plans so that you can choose one with the maximum features aligned to your business.

Prerequisites For QuickBooks Data Migration Tool

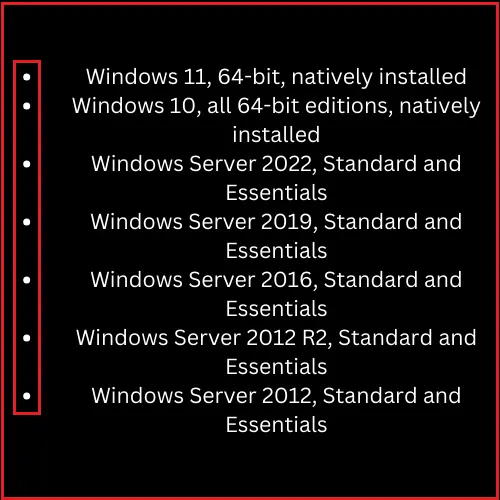

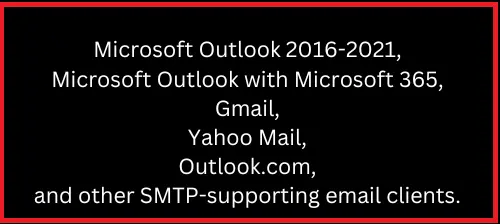

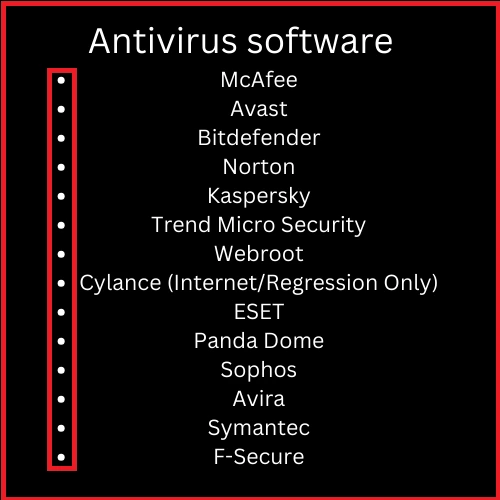

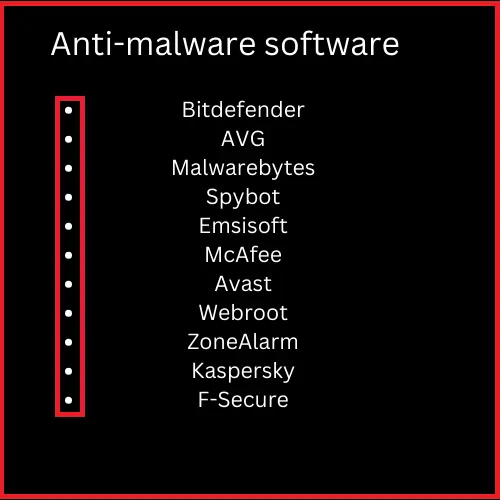

QuickBooks Data Migrator is an efficient tool in the application that facilitates smooth data migration without any loss or disruption. If you want the tool to work best for you, make sure that all the prerequisites for the system are fulfilled. Some common system requirements for QuickBooks Data Migration Tool are:

- You can’t think of this tool to run without having a stable Internet connection. Make sure that your devices are connected to a strong Internet connection.

- An external storage device with adequate capacity to store your financial data.

- Make sure that you run QuickBooks with the admin login credentials, as it allows you to make important changes in the program.

- The second device should also be connected to an unshakeable Internet connection.

Now that you have all these prerequisites ready, you can move ahead with the data migration procedure.

Download The Latest Version of the QuickBooks Migrator Tool

The steps will help you download the tool without needing to go anywhere else:

- First of all, you need to click on the Download button, and the tool will be downloaded to your device.

- From the download location, double-click on the executable file to install the tool.

- Now, click the Next button and agree to the Terms and Conditions when you are prompted to do so.

- Wait for the installation to finish, and the QuickBooks Data Migration tool is good to go.

Data That Can Be Migrated

Let us have a look at the type of data that can be migrated via the migration tool.

- Finance Statement Designer (FSD data) and (FSD clients).

- Advanced reports (QuickBooks Enterprise).

- Statement writer (QuickBooks Accountant).

- Information about QuickBooks Desktop, such as the versions.

- Printer Setting (wpr.ini), (PrintEng.ini), and (QBPrint.qbp).

- Memorized reports with local attachments and scheduled reports.

- Cash Flow Projector (.cfp).

- QuickBooks letters, custom templates, and forms.

- Business Planner (.bpw).

- Spell Checker (spell.ini) and (UserDictionary.tlx).

- Loan Manager (.lmr).

- The last three company files you accessed on your previous PC (including sample documents).

Data That Can Not Be Migrated

You can not migrate the below-mentioned data via the tool.

- Payment and payroll syncing

- Configuration of Multi-user mode

- Backup files

- Intuit Data Protect (IDP)

- Older than three Company Files

Procedure To Run QuickBooks Plus Desktop 2023 Data Migration Tool

Now you have the tool installed on your device; you can accomplish the desired task by running it in an appropriate manner. The procedure will be carried out from the old system to the new system in the following chronology:

Starting From The Old Computer

- Log into the QuickBooks application by entering the accurate login credentials.

- After successful login, click the Menu option and then select Utilities.

- Thereafter, you will have to click on the option that says, Move QuickBooks to another computer.

- Once you are all set for the migration process, click I am Ready option.

- Now follow the on-screen prompts and choose an external device (USB flash drive) to copy the data.

- The data copying may take some time, so wait patiently until the job is done.

Here, you will have to enter an OTP to proceed further with the task. At once, you can transfer up to three files.

Thereafter, On New Computer

- Once all the files are copied, open the system where they need to be copied.

- You need to insert the USB flash drive into the new system.

- Thereafter, you need to navigate to and run the Move_QuickBooks.bat file.

- Now, enter the password in the specified area.

- Wait for the data transfer process to complete, and then hit the Finish button, and it will bring the procedure to an end.

These steps will help you move your data from one computer to another. However, not all the data will be moved, and therefore, you need to perform a few additional steps.

Additional Steps For Complete Data Transfer

- To move the remaining data, sign into payments and payroll services.

- After that, you need to create a data backup by signing into Intuit Data Protect.

- Now, verify and confirm that all the additional files are transmitted.

- Create a backup of your company file to keep all the data intact.

Thus, you can move your accounting data to a new system using QuickBooks Data Migration Tool.

The Final Say!

Businesses needing to migrate their financial data from one system or device to another will find this post helpful. QuickBooks Migration Tool can simplify this task for businesses. However, data migration is a delicate task. You need to verify the accuracy of the data after migration. In case you have doubts at any point, it is clever to get help from QuickBooks data migration services.

FAQ's

Question:1 What type of data can’t be migrated using the QuickBooks Migrator Tool?

Ans. If you have opted for an automated data migration using the QuickBooks Migration tool, know that it will not move all the data to the new system. The list of such data includes:

- More than three Company Files

- Multi-user mode setup

- Payment and payroll syncing

- Backup files

- Intuit Data Protect (IDP)

Question:2 What do you do after migrating your financial data to QuickBooks?

Ans. After migrating your data, you need to check and verify that the integrity of the data is still intact. You can run reports on your legacy and new systems to make sure that they are correct. Thereafter, you need to configure your company file. Moreover, also configure your sales tax settings and connect your bank & credit card accounts.

Question:3 What is an alternative way of transferring QuickBooks data?

Ans. If you don’t think that QuickBooks Data Migration Tool is a reliable way to migrate your data, you can do it manually by implementing the below-listed steps:

- When on your old system, create a backup of your company data.

- Now, uninstall QuickBooks from your old system.

- You can now install the QuickBooks application on your new device and restore the backup on the same.

Question:4 How do you connect with QuickBooks data migration services?

Ans. If you need help with QuickBooks data migration, you can connect with us, and our professionals will move your current data to your preferred device or the versions of the QuickBooks application. The services will prepare your data for export, move it while preventing any kind of loss or disruption, and ensure the integrity of the migrated data.