Being a business owner isn’t an easy job, as you have to take care of all the business segments like sales, marketing, and finance. However, to run the business smoothly, keeping track of the business finances is very important. Considering this, it is crucial to have the topmost accounting solution to meet your accounting needs. Undoubtedly, both Wave Vs QuickBooks are flawless accounting software that reduces the stress of handling business accounting tasks alone.

Furthermore, if you are still confused about what to choose, “Wave Vs QuickBooks”, then study this post attentively. By reading this entire blog, you will get to know the feature and functions of both software, which will help make the right decision for your business.

A Brief Introduction About Wave Accounting Software

Wave is rated as the top-notch accounting software mainly used by small businesses and small proprietors. Moreover, this software also enables you to combine Credit Card Processing and Payroll Services for a cost. In addition to this, it allows you to keep track of the accounts, manage invoices and bills.

Enhanced and Updated Features of the Wave Application

If you wish to grab more details regarding the benefits of the Wave application, you must go through the following pointers.

- The wave application allows users to apply for insurance.

- Now, the payroll managers can utilize the Payroll Tab and accurately handle all payroll-related tasks without further delays.

- Moreover, the users can also invite another user regarding some specific performance of your business and software.

- Apart from this, the users may also use the feature of inbuilt integration with Google Sheets and PayPal.

- Above all, the Wave application is easy to use and creates settings.

A Quick Glance At the Explanation of the QuickBooks Software

QuickBooks is another world-class accounting software that helps businesses with inventory management, payroll, bookkeeping, and other financial processes. Moreover, this accounting software is mainly designed for small, medium, and large-scale businesses. Apart from this, it also provides several top-notch features that make it extraordinary accounting software.

Improved and Enhanced Features of the QuickBooks Application

Here, we have described all the latest and improved features of using the QuickBooks Desktop application. Go through them attentively.

- The users can utilize the latest Cash Flow Hub feature to verify and handle the cash flow in the business or industry.

- You can easily keep track of the vehicle’s mileage by utilizing the QuickBooks Desktop Plus, and Enterprise.

- Moreover, QuickBooks has a user-friendly interface that makes it easier for users to run the accounting application.

- Above all of this, QuickBooks helps users in the bank reconciliation process so that you can easily spot discrepancies between the bank and your QuickBooks account.

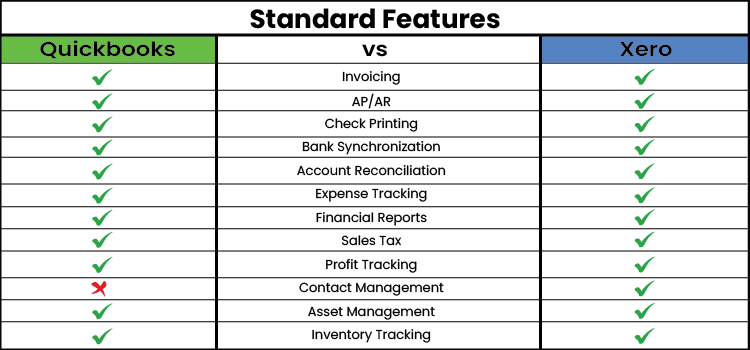

Comparison of Wave Vs QuickBooks Accounting

Now that you have gone through both QuickBooks Vs Wave Accounting software but are still confused about which one is better. So, to make your doubt clear, we have discussed the similarities between both accounting solutions. Thus, it will offer you a clear vision of the two software and help you make the appropriate decision.

| Basis | QuickBooks | Wave Accounting |

| 1. Feature | QuickBooks is the world’s topmost accounting software that helps streamline business accounting tasks. | Wave is the widely used accounting solution that enables small businesses and freelancers to handle double-entry accounting. |

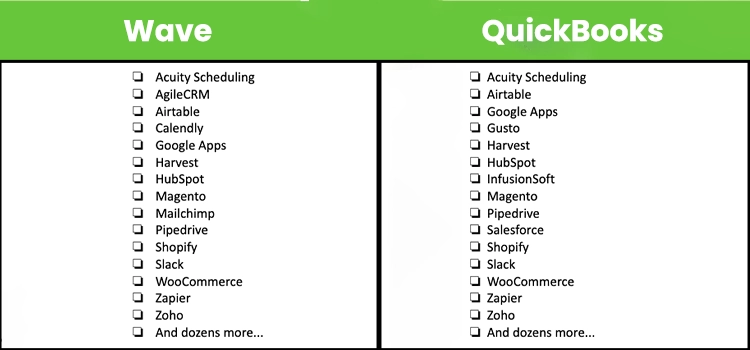

| 2. Integrations | You can combine the QuickBooks application with more than 750 applications. | On the contrary, Wave accounting users can combine with the in-house applications, including Wave Payments and Wave Payroll. |

| 3. Feature | The plans of the QuickBooks application start at $30 monthly. | The Wave Accounting application is a free-of-cost software. |

| 4. Customer Support | QuickBooks provides its users with a 24*7 customer support facility. | On the other hand, the support for non-paying users is only restricted to Chatbox and Self-Service Help Center. |

| 5. Ease of sharing with Accountants | With the QuickBooks application, you can do audit trials, and it also offers accountant access. | The main advantage of the Wave application is that it offers easy accountant access but no audit trial. |

| 6. Best For | QuickBooks application is designed to cover more complex business requirements and is best for small, medium, and large-scale businesses. | Wave application has an easy-to-use interface, and it is mainly designed for freelancers and small-scale businesses. |

| 7. Print Checks | QuickBooks users can create and print checks. | On the other hand, the Wave application won’t provide the option to print checks. |

| 8. Number Of Users Access | With one QuickBooks subscription, up to 25 users can access the accounting software. | No restriction exists on the number of users utilizing the Wave application. In short, unlimited users can access this software with one single subscription. |

| 9. Manage Inventory | QuickBooks provides its users with an inventory management feature. | Wave application won’t provide the inventory management feature. |

How To Make the Decision Between Wave Accounting Vs QuickBooks?

Are you still facing challenges while making a decision between Wave Accounting Vs QuickBooks? If that’s so, then we have a solution for your problem. Here, we have discussed all the instances when you must go with the Wave and QuickBooks applications. Thus, it will help you in improving your decision and help you in getting the right fit for your business.

When You Must Go For Wave Application?

Both QuickBooks Vs Wave has different functions and features, which makes them the best accounting solution. However, to give you more clarity on why you should go for the Wave application, we have highlighted some of the instances below; check them out.

- The Wave applications comprise Optical Character Recognition and endless Cloud Storage feature for receipts. With the help of both of these features, you can scan the receipt conveniently.

- If you are a freelancer, consultant, designer, writer, or small agency then Wave is the appropriate fit. This is so because this accounting solution offers user-friendly features which make it easy to use the software without much technical knowledge.

- Moreover, the best part to choose the Wave application is that it is easy to set up and doesn’t require much technical experience.

- Last but not least, Wave is a free accounting software so you don’t have to spend a lot of money in getting the best fit for your business.

Why You Must Pick The QuickBooks Desktop Application?

Below, we have discussed the instances when you can utilize the QuickBooks application.

- For instance, if you wish to get a complete package of Basic to Advanced-Level Accounting features with payment plans, then QuickBooks is the one you must go with.

- The Wave accounting software can’t fulfill all the complex business requirements whether for bookkeeping, inventory management, payroll features, Vehicle Mileage, etc.

- QuickBooks is the topmost accounting software for large-scale businesses.

- If you are looking to expand your business, then picking QuickBooks isn’t a bad option.

- Moreover, it also offers various enhanced and top-notch accounting features which are not provided by the Wave application.

Final Thoughts!!

With this post’s help, we hope that now you are capable enough to make the decision between Wave Vs QuickBooks. Thus, we hope it eases you in taking the best decision which will be helpful for the growth of your business. However, if still you are encountering any difficulties while picking the best fit for your company out of these two, feel free to take suggestions from our professionals. You can consult with our experts anytime via live chat or email support facility.

Frequently Asked Questions:-

Q1. Can I integrate the Wave application with QuickBooks?

Ans. Yes, using the Zapier which is an e-commerce integration feature you can send any information from QuickBooks to the Wave application.

Q2. Is the Wave application appropriate software for the payroll?

Ans. There is no doubt that Wave is the best payroll solution that offers time tracking, and payroll processing for both employees and contractors. But, it won’t automate payroll or gives the mailing facility for paychecks. In that scenario, QuickBooks is an outstanding application for managing payroll.

Q3. What features must I search for in the accounting software?

Ans. If you are searching for the best accounting software, then you must consider the following points.

- Check that the software is best for handling accounts payable, banking, cash management, cost tracking, inventory management, etc tasks.

- Moreover, you must also verify whether the software consists of a mobile application.

- Also, you must look that you are getting customer service.

Q4. Can we rely on accounting software for safety and security?

Ans. Nowadays, accounting software offers high-end security features including data encryption, secure credential tokenization, multi-factor authentication, etc. So, it keeps your data safe and secure as it offers limited access to the users.

Q5. Can I export Wave Accounting to QuickBooks?

Ans. No, you can’t connect directly with the QuickBooks application. For exporting the Wave to QuickBooks, export transaction details, customer reports, etc in ZIP file to CSV or Excel files and then export it to QuickBooks.