When QuickBooks internal file has become unreadable and shows an error message PS107 on your computer screen, this error occurs while downloading Payroll Updates. You will observe that reasons lead to QuickBooks error PS107 and then visit the solutions.

Reasons Behind QuickBooks Error PS 107

- Server Weak Issue

- The old form of Finance Programming supports an early form of finance as they create a new one

- A virus or spyware infecting the system

- A corrupted file in the QuickBooks

Methods to Resolve QuickBooks Error PS107

Few troubleshooting solutions are given below to fix QuickBooks error PS107. Let’s go through them carefully.

Method – 1

- First, move to the Task Manager and click on the processes tab

- Now display all applications beginning with QuickBooks

- Now click the End Task or End Process.

Method – 2

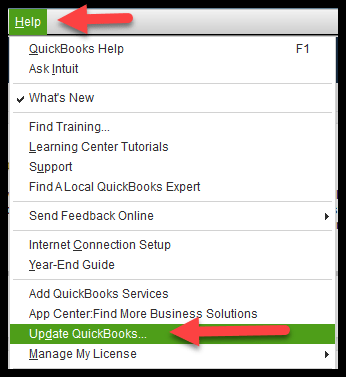

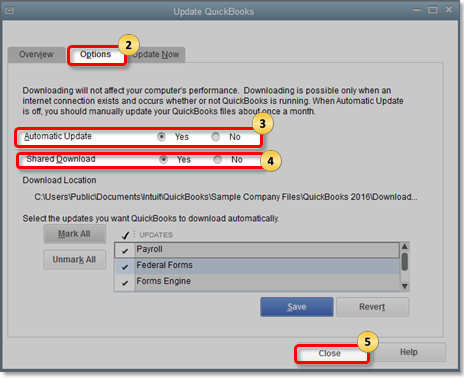

- Move to the Help menu and choose Update

- Click options and click the Mark all button

- Press update now

- Now press Reset Update and click on the Get Updates

- Once you observe Update Complete message, shut down QuickBooks Desktop.

Method – 3

- Access Get Payroll Updates now and implement the Payroll Update CD

- Press on Employees and click on Get Payroll Updates for pro and premier

- Suppose you have been asked to search for update.dat or update3.dat, then respond to the notifications

- Press on Browse

- Choose the CD Drive from the Look in the drop-down menu

- Select update.dat or update3.dat in the Payroll Update now and click the Open option

- Click Ok.

Method – 4

- First, unclose the Run command on the keyboard and click Ctrl+R

- Now enter misconfig. and press Ok

- Tap selective startup, load system services, and load startup items in the General tab

- Now press the Services

- Choose Hide all Microsoft services and click on disable

- Press to remove Hide Microsoft services

- Now choose the services and make sure that the Windows Installer checkbox is established

- Now choose and press Ok; if it is not available there, then move to the system configuration window

- Click restart your computer

- When the system is restarted, then do activate a clean install.

Method -5

- Switch to single user mode by pressing

- Press switch to a single user

- Select Backup Company and click create local option available on the QuickBooks file menu

- Press on local backup once you have the backup window option and select the location for backup

- Next click Ok

- Inspect for the options on this page and select the one you like

- Select the appropriate option for you once you are completed with Ok

- Press Ok in the Create Backup option

- Organize future backups and choose to save your backup now.

Once you have followed the above methods, you can eliminate QuickBooks error PS107. To rectify QuickBooks quickly, you must dial the QuickBooks support number to get some accurate tips.

FAQs ( Frequently Asked Question)

Ques. How to Troubleshoot QuickBooks Payroll errors?

Ans. Some troubleshooting steps are given below to fix QuickBooks payroll errors.

- Press the Help menu

- Select about QuickBooks

- Click Ctrl+Alt+Y at your keyboard, then press on Next

- Choose the employee who was underpaid in the employee information window

- Do a double-click on the employee’s name

- Analyze the YTD adjustment details

- Press Ok.

Ques. Can I switch from QuickBooks Desktop to Online?

Ans. It depends upon your monthly subscription and the cheaper cost. QuickBooks is cost-effective if you use multiple employees using the software. QuickBooks Desktop Pro is affordable if you don’t require additional users and planning to utilize software before updating.

Ques. How to control Payroll errors?

Ans. Some troubleshooting steps are given below Payroll errors.

- Briefly indicate the error and apologize

- Explain what brought on the problem and observe

- Describe what methods are taken to fix this problem and confirm that it should not be repeated.

Ques. Do you require to purchase a QuickBooks desktop every year?

Ans. QuickBooks desktop is available for yearly subscription or purchase with an extra price per user.