Are you facing trouble while connecting with your bank account with QuickBooks? QuickBooks error 350 is a faulty situation when you may encounter a similar situation. This error can take place when the connection expires or is updated by the bank while using the Banking menu. With the error, there comes a warning message, as shown below:

“Can’t Connect Bank Error 350”

“The old connection doesn’t work”

Every time the QuickBooks error code 350 pops up, the users fail to download the bank transactions. Thus, it prevents the users from doing their ongoing business operations. At this moment, it becomes crucial to resolve this error by targeting the possible causes and implementing the relevant solutions.

What Can Possibly Lead to QuickBooks Error 350 Desktop?

As a QuickBooks user, you can get QuickBooks Desktop error 350 while performing the banking operations. As a result, an important ongoing task gets disturbed, and you will need to determine the possible causes and solutions for the error. Below are some of the prominent causes for you to take a look at:

- Sometimes, it may happen when the server of your bank is down. This problem mainly takes place when the website is under maintenance.

- QuickBooks error message 350 will appear when performing a bank-related task.

- In other instances, it may occur when QuickBooks fails to establish a connection with the banking servers.

- Another cause may be an expired or updated connection from the bank’s side.

- The corrupt data file containing the transactions is also one of the many reasons that can lead to QuickBooks Error Code 350.

What Signs Should I Focus On To Identify the QuickBooks Error Code 350?

The following signs and symptoms will help users determine the occurrence of QuickBooks Error Code 350:

- The task of linking your banking server becomes challenging.

- Sometimes, this error might create issues during the invoice creation or payment process in QuickBooks.

- There might be the possibility that your old connections won’t remain the same.

- The users might discover that their bank connection fails to work.

- Moreover, the users won’t be able to match the security questions.

Simple Procedures to Overcome QuickBooks Error 350 Transfer of Credits

Are you sick and tired of finding the appropriate solutions to resolve QuickBooks Error 350 Transfer of Credits? If that’s the case, then you have landed at the right place. Here, we have covered all the effective solutions that will help you deal with the issue in the least time possible.

Resolution Way 1: Relink Your Bank or Credit Card Account

You must carry on with the stepwise instructions listed below to relink your bank or credit card account.

- In the initial step, you must launch QuickBooks Online on your device.

- After this, navigate to the Banking menu or Transactions menu.

- Now, you must choose the blue square for the account you wish to reconnect.

- Advancing in the procedure, hit the Sign In link.

- Thereon, you must add the User ID and Password required to log in to your bank’s website.

- Now, pick the accounts you wish QuickBooks to download the transactions for. Later on, pick the highlighted Continue button.

- Once you are all set, hit the Update option to download the latest transactions from your bank.

If the Quick bank error 350 is not resolved here, move to the next solution.

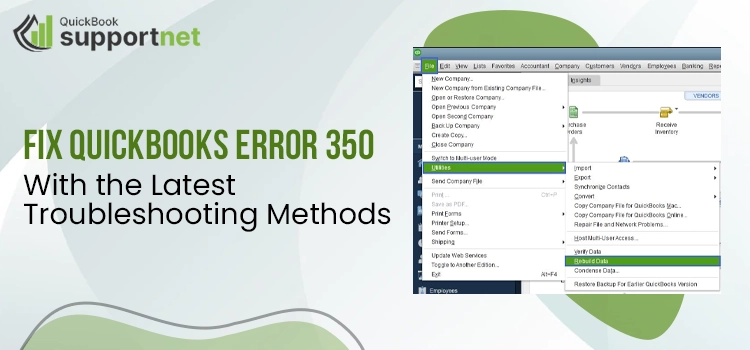

Resolution Way 2: Utilize the Verify and Rebuild Data Tool

To fix the damage present in the QuickBooks company file, you must use the Verify and Rebuild data tool. For that, you must apply the resolution methods explained below closely.

- Begin the process by launching the QuickBooks software on your device.

- After this, move to the File menu, followed by the Utilities option.

- In the next step, navigate to the Verify Data (used to verify if the company file is damaged or not) option.

- If you find out the data is damaged, you get the message, “Your Data has lost its integrity”. In that scenario, you must run the Rebuild tool.

- Thereon, proceed further to the File menu and hit the highlighted Utilities option.

- Go further by hitting the OK button and then pick the Rebuild Data (used to rebuild the damaged data in QuickBooks) option.

- Now, pick the appropriate data backup location and hit the OK button.

- Once you have generated the backup data file, the tool will begin to reconstruct the corrupted data to overcome QuickBooks error 305.

Check if the error 150 in QuickBooks is gone or still persists. If not resolved, try the next method.

Resolution Way 3: Locate the Error in the QuickBooks Log File

You must apply the steps instructed below to find the error within the QuickBooks Desktop log file:

- Primarily, access the QuickBooks homepage and hit the F2 key to launch the Product Information window.

- Soon after this, choose Tech Help by hitting the F3 key on your keyboard.

- Proceed further by clicking on the Open File tab and then look for the log file. Once you have found the file, tap on the Open File button.

- Finally, you must look for the error message and the transactions that might evoke the QuickBooks error code 305.

Resolution Way 4: Eliminate the Web Browse Cache Files

The browser’s cache files often create issues while syncing with the bank website. So, to resolve the issue, you have to remove the unnecessary cache files of your web browser to resolve the error code 305 in QuickBooks.

For the Users Accessing Google Chrome:

- In the first place, launch Google Chrome on your device.

- After this, see the three vertically placed dots on the top right corner of the screen.

- Thereon, choose the History option from the extended list that opens up on the screen.

- Proceed further by hitting the Clear Browsing Data tab.

- Next, you must choose the time range from when you want to delete the history.

- After making the appropriate choice, pick the Clear Data option.

- Finally, relaunch the Chrome browser and try to sign in to your bank account to determine whether you are still getting QuickBooks Error 305.

If You Are a Mozilla Firefox User

- First of all, move to the menu tab of Firefox and hit the History option.

- Afterward, navigate towards the Clear Recent History option, and it will represent the window with the Time Range.

- Make sure that you have set it to everything to Clear the entire Cache and junk files.

- Ensure you have selected the cache checkbox by clicking on the drop-down arrow next to the Details option.

- Soon after this, hit the Clear Now tab and shut down the Firefox application.

End the process by relaunching your browser to verify whether the issue is resolved or not.

Steps For The Users of Internet Explorer

- In the beginning, launch the Internet Explorer on your device.

- After this, hit the Gear icon and then choose the Safety option.

- In the next step, pick the Delete Browsing History option and check that you have left the checkbox of Preserve Favorites Website data unmarked.

- Thereon, mark the Temporary Internet Files checkbox and hit the Delete button followed by OK.

Final Words!!

We assure you that the above information will help you resolve QuickBooks Error 350. However, if you still need help, connect with our professionals anytime via the live chat facility. Our highly-trained professionals will assist you with stepwise instructions to resolve the issue. Otherwise, you also have the option to send the mail to the experts and get all your doubts clear within no time.

FAQ's

Q1. What do you understand by Error 350 in QuickBooks?

Ans. The users must update everything to refresh their bank or credit card account connection. There are a few banks that you have to update it after every 90 days, whereas others require an update after every 18 months. However, if the connection expires, users might encounter Error 350 in QuickBooks.

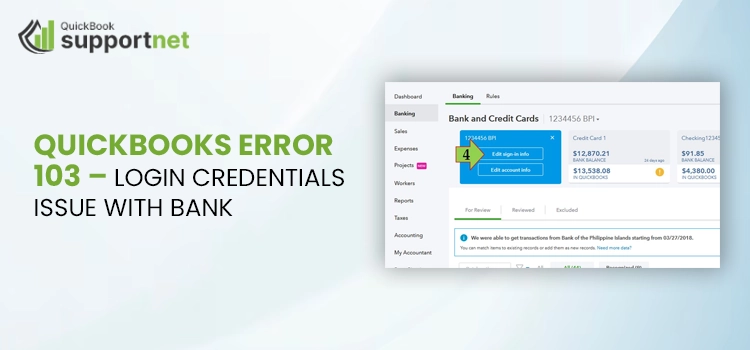

Q2. What are the steps to rectify bank errors in QuickBooks?

Ans. The users must perform the following steps to resolve bank error in QuickBooks.

- Primarily, move to Bookkeeping > Transactions menu > Bank Transactions.

- Now, pick the tile for the bank account and hit the Edit icon.

- Following this, hit the Edit Sign-In Info and then update the details as per your requirements.

Q3. What are the after-effects of QuickBooks Error 350?

Ans. On the occurrence of QuickBooks Error 350, users won’t be able to connect with their bank account. Also, they might face issues while downloading the latest bank transactions.