In today’s time, where most people prefer working remotely, online banking plays a crucial role for businesses. Moreover, it helps organizations accomplish their bank-related tasks online instead of visiting the banks. No matter whether online banking comes with several benefits, it also has certain flaws. Similarly, while using the online banking feature in QuickBooks, users might encounter QuickBooks Error 323. You might be wondering why it happens. This error mainly occurs when the users include the same account twice in your product.

However, you no longer have to worry if you are on the same page and getting Error 323 QuickBooks. This guide will help you understand all the factors responsible for the error. Alongside simple tricks to overcome this banking error so that you can regain access to online banking.

Is QuickBooks Error 323 getting problematic for you and preventing you from doing online banking? Contact us at +1-855-603-0490 and obtain expert tips to overcome the issue instantly.

Get A Detailed Insight Into QuickBooks Error Code 323

There might be certain instances when the users result in QuickBooks Error Code 323 because of using login credentials that aren’t approved by the financial institution’s website. It could happen when the users make typing mistakes while adding the credentials. Otherwise, it may trigger due to some browser-related issues.

As a result, this error might obstruct the users from processing any transaction and lead to payment delays. Therefore, fixing this error at the right time is important before it gets too late with the correct methods explained further. But before fixing the error, let’s first look into the root causes behind the issue. So, let’s get started!!

Why Does Banking Error 323 in QuickBooks Online Flashes On the User Screen?

The users might receive Error 323 in QuickBooks Online while using the wrong login credentials to use online banking. However, it could also be caused due to multiple other factors. Therefore, we have specified some below to update you on all such factors.

- Your financial institution may have transferred their account details to another server.

- Sometimes, QuickBooks Error 323 may trigger when you have picked the same name for two distinct accounts in QBO.

- You are trying to open an account that has been closed by your financial institution.

- In other instances, it may happen when you are accessing two accounts having the same account name and number.

Advisory Tips Before Resolving QuickBooks Banking Error 323

Remember the following points to fix the QuickBooks Banking Error 323 smoothly.

- The very first thing is that you must check the stability of your internet connection.

- Another important thing is to cross-check your login credentials while signing into online banking in QBO.

- If you cannot log into your bank account, even using the correct login credentials, try to login via another web browser.

- Make sure that your financial institution has yet to make any recent changes.

Simple Tactics to Troubleshoot Error 323 QuickBooks Effortlessly

We understand it gets quite annoying when making payments via online banking; users suddenly encounter Error 323 QuickBooks. Therefore, follow the steps outlined below to fix the error efficiently without making much effort.

First Troubleshooting Method: Give a New Name to the Account On Your Bank’s Website

- In the first place, go to the Banking option and pick the account you wish to rename.

- After this, click the Edit button followed by the Edit Account Information.

- Consequently, you will get an Account Window on your computer screen.

- In the next step, find and hit the “Disconnect the account on Save” option.

- Conclude the process by clicking the Save button to restore all the changes made to the account name.

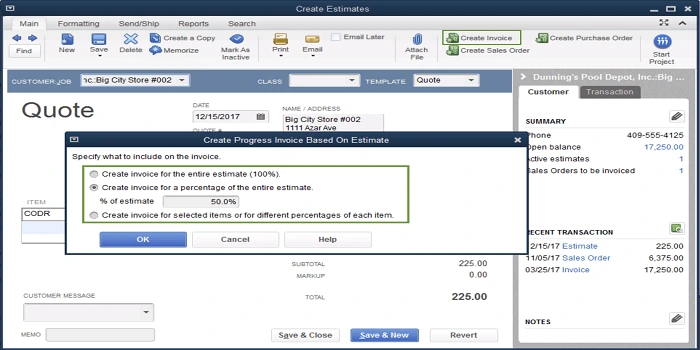

Second Troubleshooting Method:- Remove Any Of the Repeated Account

There might be instances when the users make the same account in QBO twice. As a result, it may give rise to QuickBooks Error 323 and stop them from accessing online banking. So, it is a must to remove any account to avoid any further discrepancies using the steps below.

- Before initiating the process, you must review the side effects of deleting accounts. Once done, you must go ahead.

- After this, find and click on the highlighted Gear icon.

- Thereon, select the Charts of Accounts (COA) option and search for the account you wish to remove.

- Once you get the account, tap the Delete button and then the Confirm tab.

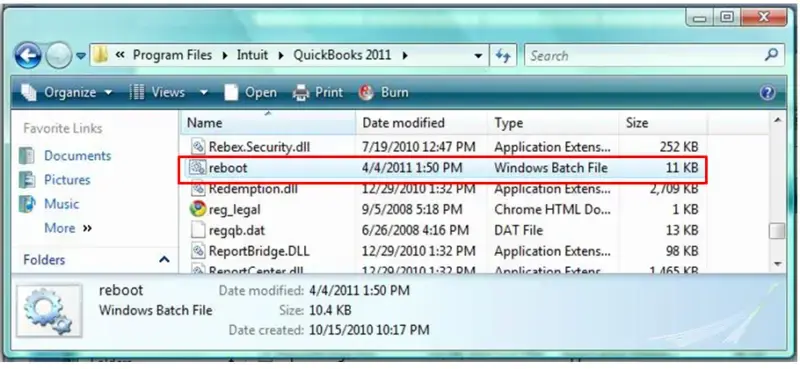

Third Troubleshooting Method:- Get the Required Transactions Downloaded

- Initially, you must launch the Settings menu in the QuickBooks Online application.

- Afterwards, choose Setting Up a Transaction and click My bank is not listed option.

- Eventually, you will observe that the latest date will be shown after the list is refreshed.

- In the next step, hit the Show List option from the menu and include the name of your financial institution. Alongside this, you must add the login details to proceed further.

- Consequently, you will see the screen containing the list of all accounts along with the bank details.

- End the process by connecting every account with the appropriate one.

Fourth Troubleshooting Method:- Bank Statements Must Be Downloaded

- Choose the Charts of Accounts option from the menu list in the first step.

- After this, pick the bank account you have chosen to conduct the online banking.

- Thereon, hover your cursor over the Download Bank Statement option.

- In the next step, hit the Add option from the View In appearing window of the Online Banking Centre.

- In the end, you must choose the option to download the statement.

Fifth Troubleshooting Method:- Importing and Exporting Charts of Accounts

You must follow the instructions below to import and export the charts of accounts in QuickBooks Online.

Steps For Exporting the Charts of Accounts

- Primarily, go to the QuickBooks File menu and hit the Utilities option.

- After this, navigate to the Lists to IIF files beneath the Export option.

- Now, all you need to do is to save the file to the desktop after picking the Charts of Accounts.

- End the process by generating a new file.

Steps For Importing the Charts Of Accounts

- Begin the process by choosing the QuickBooks File menu followed by Utilities.

- Thereon, you must hit the Import option and then move to the next step.

- Next, select the highlighted “IIF Files” below the Import option.

- Afterwards, search for the Charts of Accounts and save the IIF file to your desktop.

Let’s Wrap It Up!!

With this, we conclude this entire post and hope that the methods explained in this post will help you fix QuickBooks error 323. If you still can’t use online banking due to this issue, consult our professionals for sure-shot solutions. You can get in touch with our experts via live chat or email them explaining your query.

FAQ's

Ques 1: How does the QuickBooks Error 323 hamper your workflow?

Ans. Users who confront QuickBooks Error 323 might experience the following outcomes on their screen.

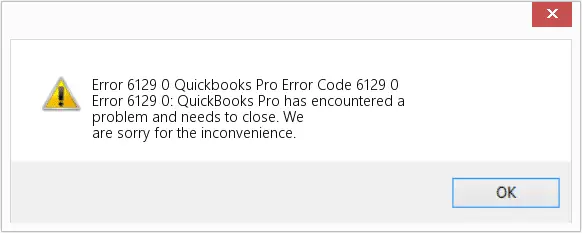

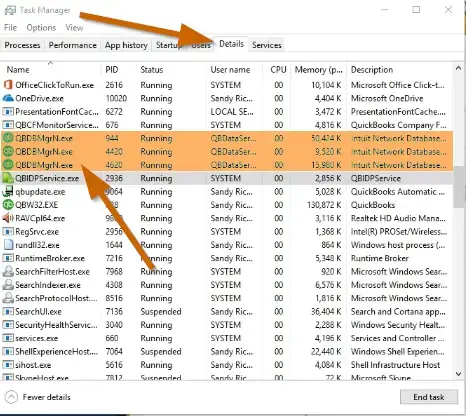

- You may experience a sudden freeze or crashing of your Windows operating system.

- At the onset of this error, the users fail to link their bank account with QBO and thus fail to access online banking.

- Your system may start working slowly.

- The users won’t be able to pay their customers as it prevents access to online banking.

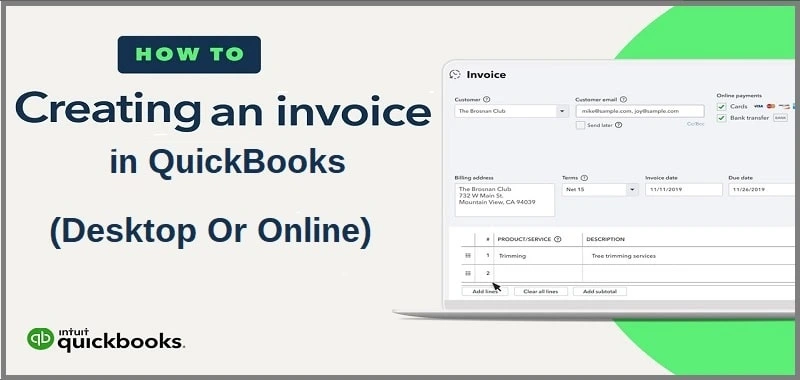

Ques 2: How can I connect a bank account with QuickBooks Online?

Ans. Go through the following instructions to connect your bank account with the QuickBooks Online application.

- Firstly, move to Transactions > Bank Transactions > Link Account option.

- You must include your bank’s URL or name and select the bank.

- Thereon, mention the login details accurately and hit the Continue button.

- Pick the account you wish to connect and date. Also, choose the account type and hit Next.

Ques 3: What should I do to trace if the bank server is down?

Ans. You must reach out to the official website of your financial institution or consult with their help desk to test the bank server.

Ques 4: Does the misconfigured internet settings trigger QuickBooks Error Code 323?

Ans. The inadequate internet settings could be one of the reasons behind the QuickBooks Error Code 323. Therefore, it is important to review and repair the internet settings if there is any issue. Thus, it would help the users overcome the error and regain access to online banking.

Ques 5: What are the possible factors behind the banking error in QuickBooks?

Ans. Here, we have listed some of the possible factors responsible for the QuickBooks banking errors like QuickBooks Error 323, 324, 350, etc.

- Issues with the bank server are one of the reasons that cause this issue.

- Another reason may be using the wrong bank login credentials.

- In other instances, it may happen when using an inadequate internet connection.

- Sometimes, it may happen when you use the incorrect URL to reach the bank website.