Dealing with the printing issue while printing the QuickBooks document? You have landed on the right page to fix the error. QuickBooks printing errors are a common issue that could pop up due to misconfiguration in printer settings within QuickBooks, or printer drivers might not be updated. Additionally, you might be using outdated QuickBooks, or the printer’s settings might not match the paper size.

In this guide, we will cover everything that even a non-technical QuickBooks user would be able to use these solutions and get the printing error fixed.

Call a senior QuickBooks specialist +1(866)500-0076 if:

- You have little or no time to fix the printing issue.

- You are looking to outsource it for a quick fix.

- Not enough technical expertise to apply these solutions.

- Need a quick fix.

What to do before you start?

- Use the recently updated QuickBooks version.

- Ensure proper connection to the printer.

- Install and use the latest printer driver.

- Your printer must not have any error messages or warning lights.

Learn to fix printing issues in your QuickBooks Desktop

Solution 1: Print from another program

- Click on Start.

- Browse to Notepad.

- Enter some text and navigate to File > Print.

- Select the correct printer and click on Print.

It is still there is no print, try solution 2.

And, if the other program won’t be able to print the document successfully, try solution 3.

Solution 2: Check the printer setup

Use these steps to check your printer’s setup.

Step 1: Ensure that the printer is set up correctly.

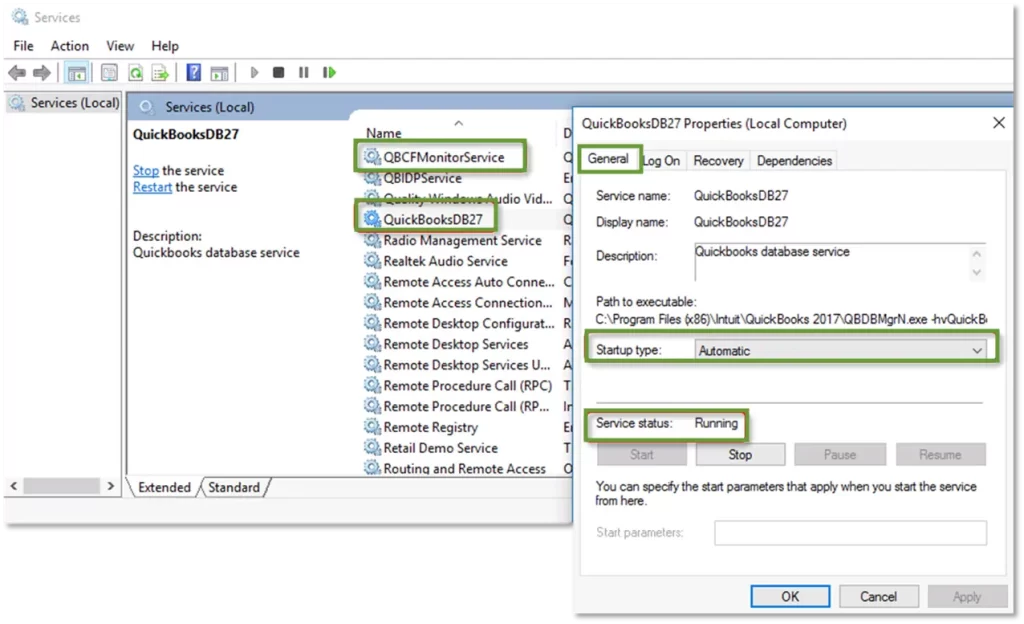

- Turn OFF your printer and restart your PC.

- Turn the printer back ON and ensure that to load the printer paper correctly.

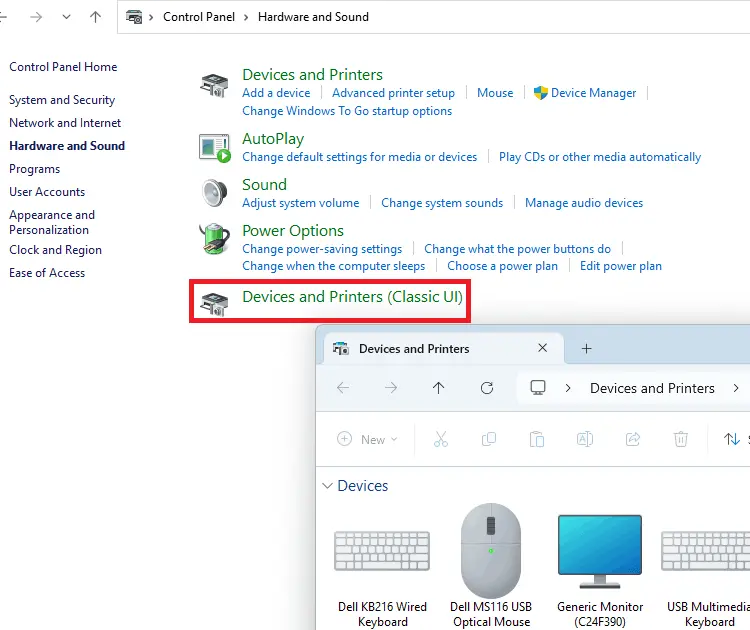

- Click on Start and open the Control Panel.

- Now, click twice on the Printers and Faxes.

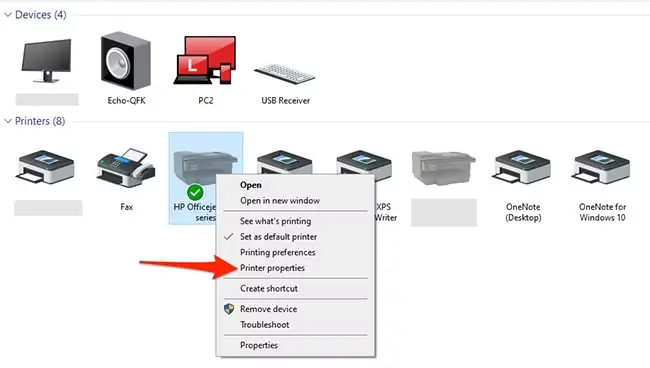

- In case the printer shows its status as Offline, right-click on the printer.

- Click on Use Printer Online.

- Click twice on the printer, and if you find any print jobs, click on the Printer option.

- Select Cancel All Documents.

- Give a right click on the printer option and select Properties.

- Choose Print Test Page.

Note: Network issues could be the cause in case it is found that the printer is a network printer, and the test page cannot be printed.

Read More – No Printer installed Error in QuickBooks

Step 2: Ensure the printer you chose is the right one

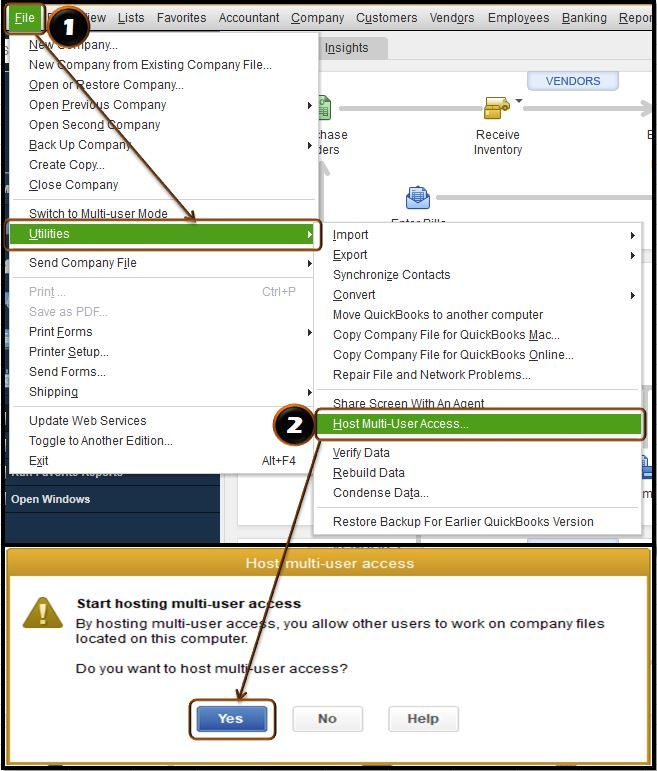

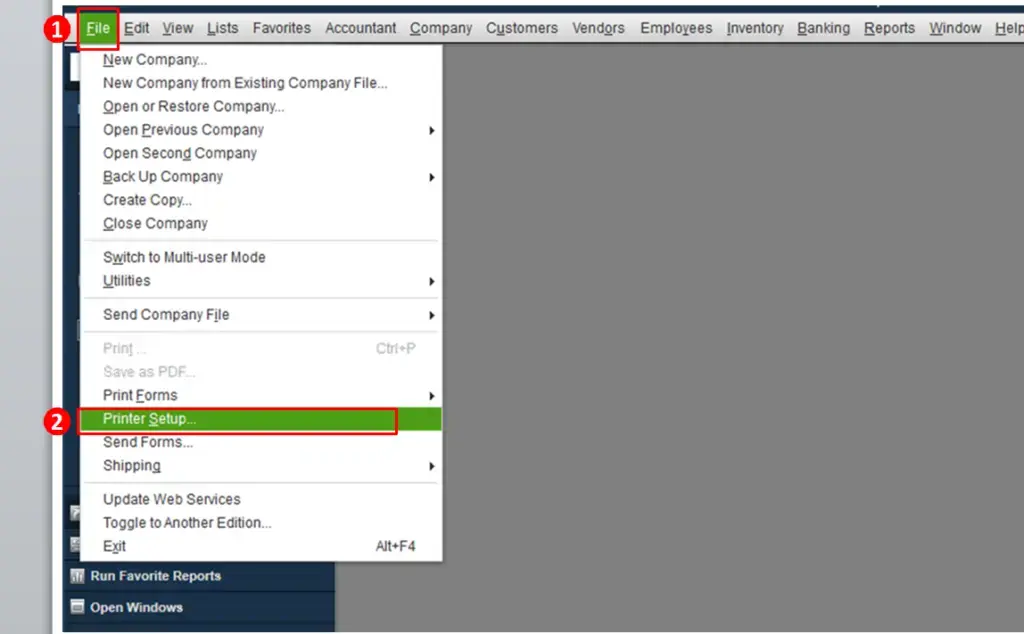

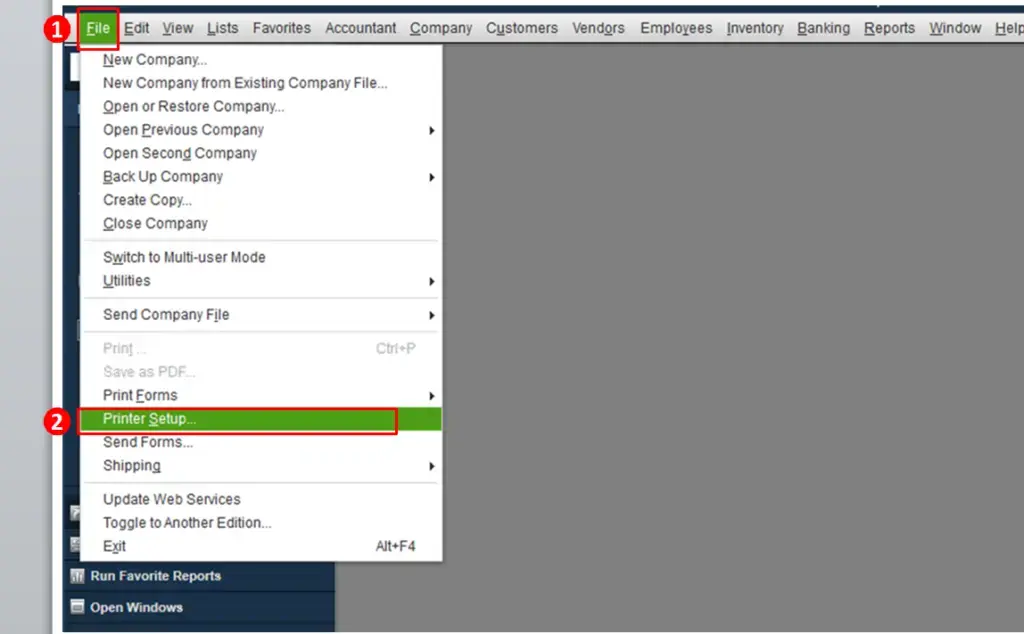

- In QuickBooks, click on the File menu.

- Choose Printer Setup and select the form you want to print.

- Ensure the printer name matches the exact name of the printer you want to use.

- If not, you will need to correct the setup within your computer’s Printer Setup first.

- Click on Help in this area for more help on these settings.

Step 3: Use a different printer to print

- In QuickBooks, click on the File.

- Click on Printer Setup and choose the form you want to print.

- Select a different printer, for example, a Microsoft XP printer.

- Click on Help in this area for more help with these settings.

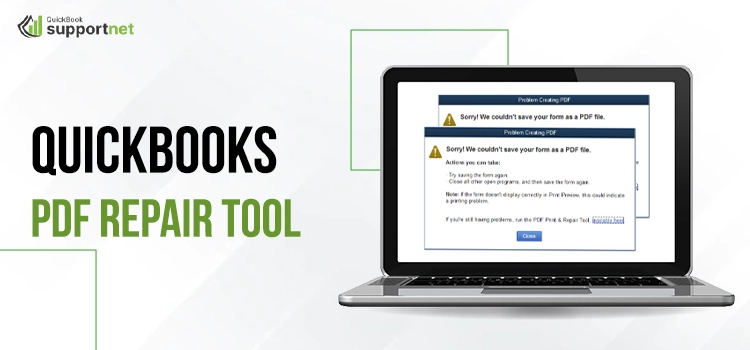

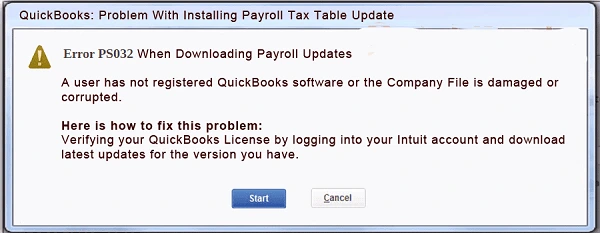

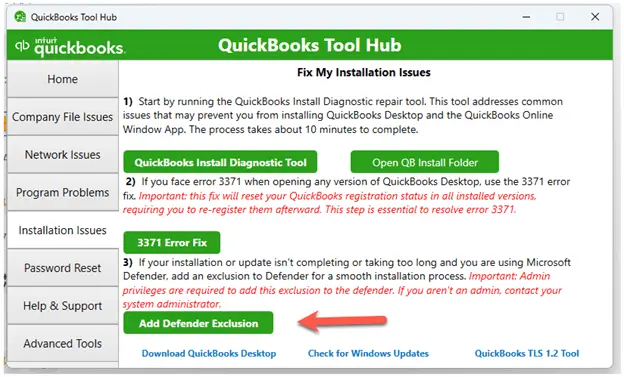

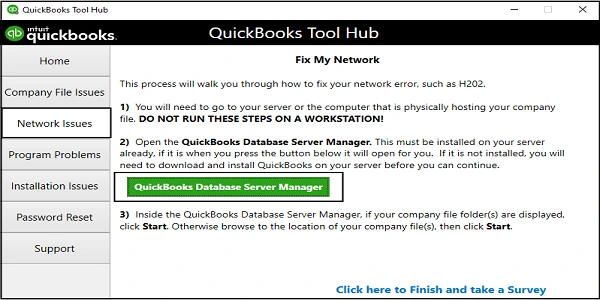

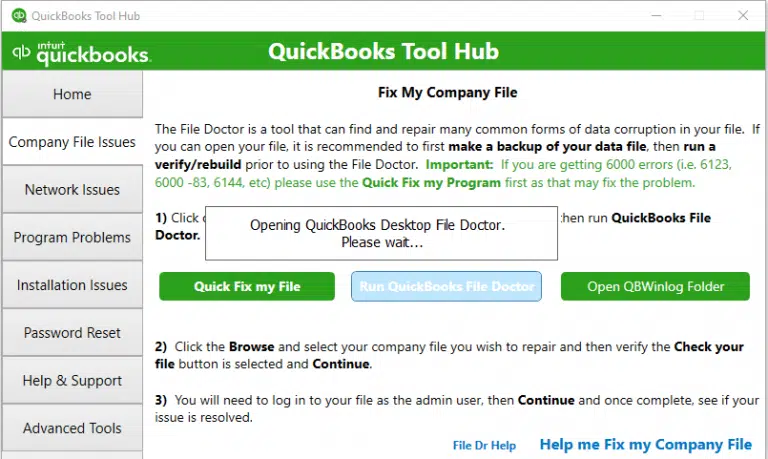

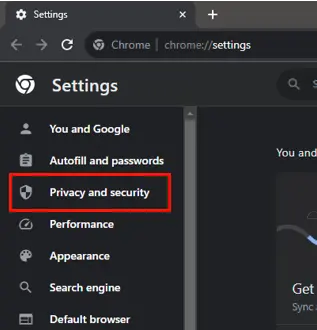

Solution 3: From the QuickBooks Tool Hub, use the Print and PDF tool.

- Exit from QuickBooks.

- Download the most recent version of the QuickBooks Tool Hub.

- As of now, QuickBooks Tool Hub 1.6.0.8 is the most recent version.

- Save your downloaded file (QuickBooksToolHub.exe) to an easy-to-reach location.

Note:- If you already have your QuickBooks Tool Hub application installed, you can check its version. Simply click on the Home tab and look at the bottom of the menu.

- Open the QuickBooksToolHub.exe file.

- Continue with the on-screen instructions and click on Agree to their terms and conditions.

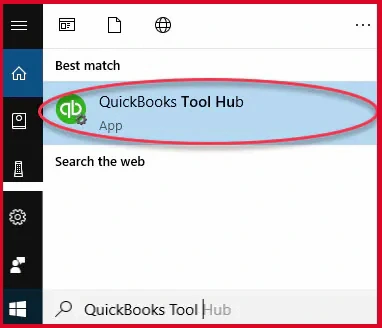

- Once you have finished the installation, click on the shortcut icon of the QuickBooks Tool Hub on your Windows desktop.

Note:- It could happen that the short icon may not be available on your desktop. In such a case, click on the Windows Start menu and search for QuickBooks Tool Hub and open it.

Learn More – How to Print Pay Stubs in QuickBooks Desktop?

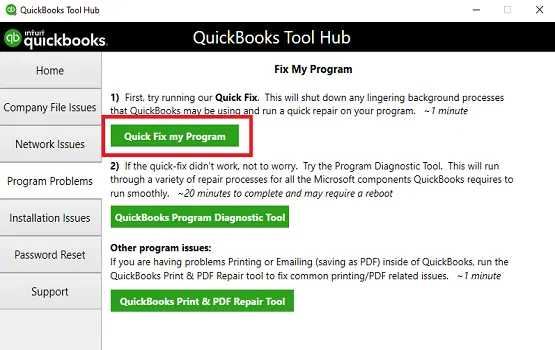

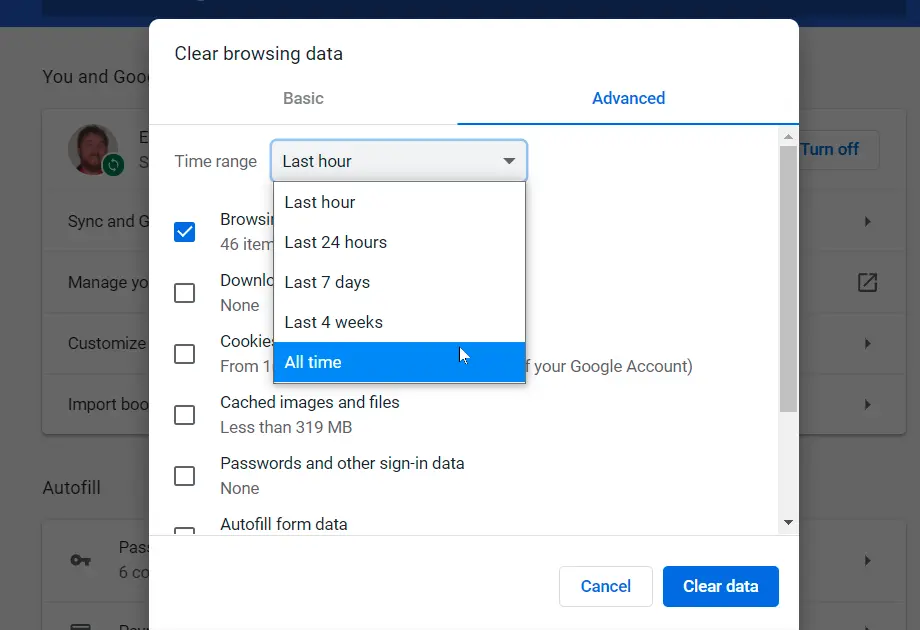

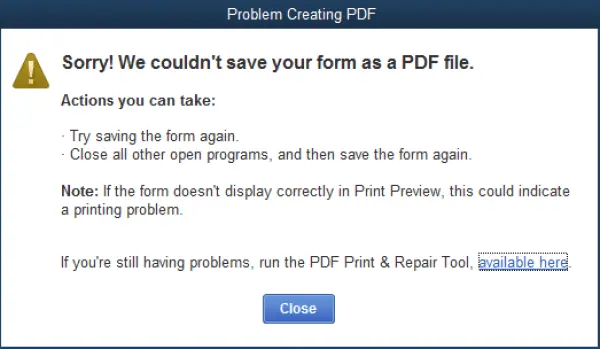

Step 2: Use the Print and PDF Repair tool

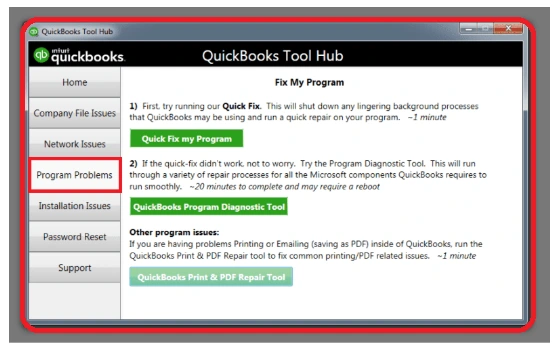

- Within the Tool Hub, click on Program Problems.

- Click on QuickBooks PDF & Print Repair Tool.

- You can either print or save the document as a PDF in your QB Desktop again.

If the QuickBooks Tool Hub does not work, manually rename the QBPrint.QBP file.

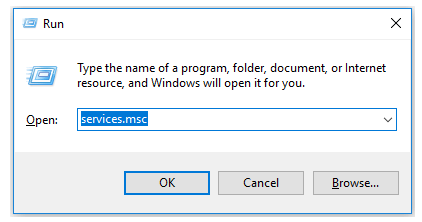

Find the QBPrint.qbp:

- Windows 10 and newer

- Server 2012 and newer

It may require that you display hidden files and folders, or you can search for files using the Windows Start menu to find the concerned files in Windows.

Also see – QuickBooks Unable to Create PDF Error

Rename the Qbprint.qbp file

- For your QuickBooks version, right-click on the QBprint.qbp file and click on Rename.

- Add extension old to the file, i.e., QBPrint.qbp.old.

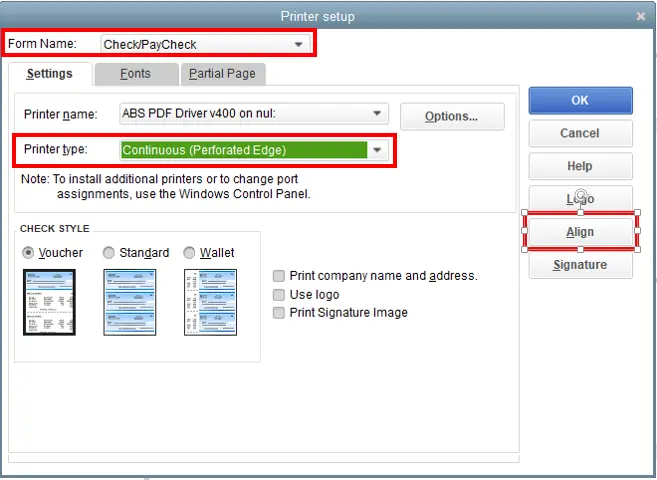

- Navigate to the File and click on Printer Setup.

- Choose any one among the transactions that must be in the Form Name list and click on OK.

- This would create a new Qbprint.qbp file.

- Now, you could open any transaction and print it.

- Check and confirm if the error is resolved or not. If you are still struggling with the error, try reinstalling the QuickBooks application on your Windows desktop.

Also Read – Print Form 1099 and 1096 in QuickBooks Desktop

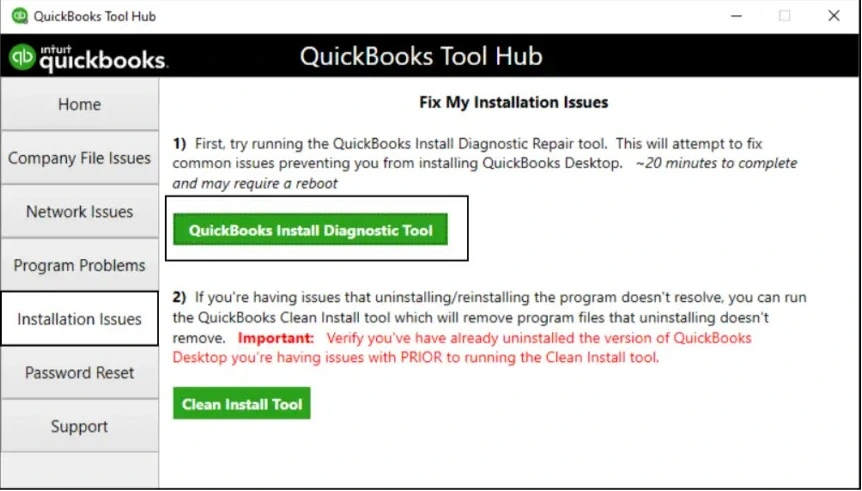

Solution 4: Clean install QuickBooks Desktop again

Step 1: Remove QuickBooks

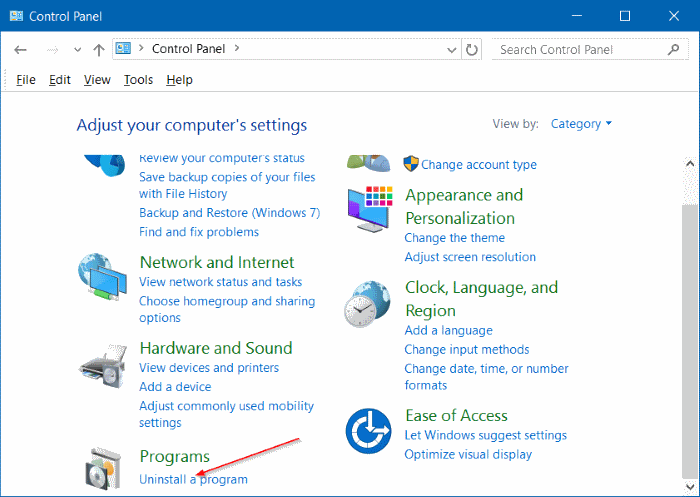

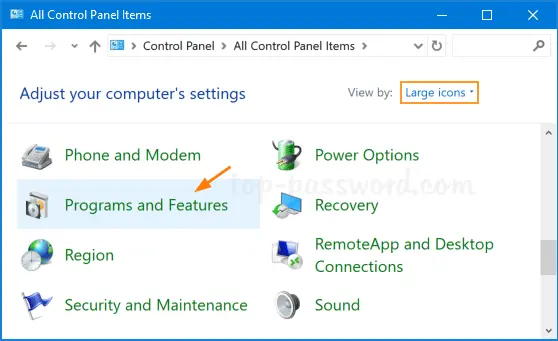

- Click on the Windows Start menu.

- Search for the Control Panel and open the folder.

- Click on Programs and Features or Uninstall a Program.

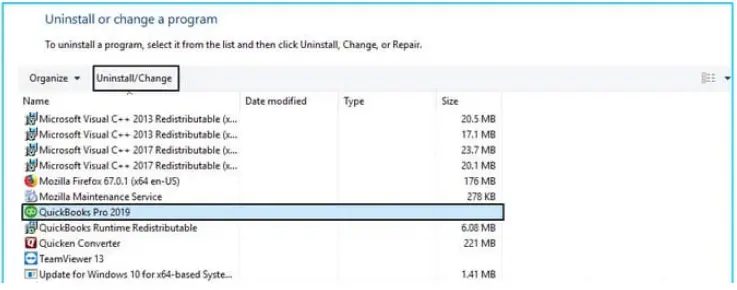

- Select the version of your QuickBooks Desktop from the list of programs that you would like to uninstall.

- Click on Uninstall/Change > Remove and hit Next.

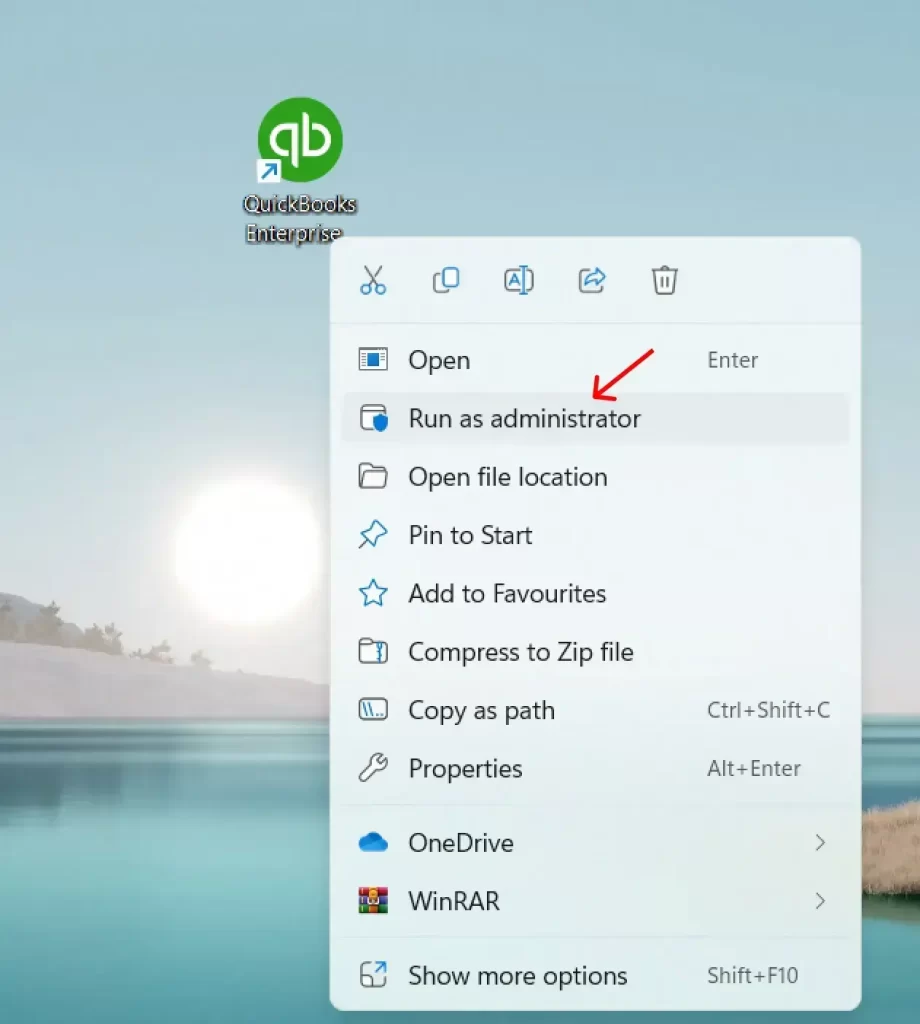

In case you do not find any of these options, you need to sign out and then sign back in to your Windows as an admin.

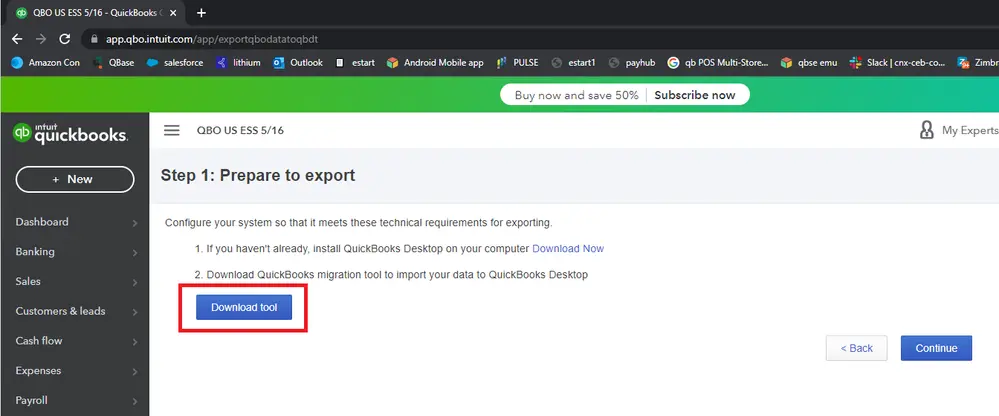

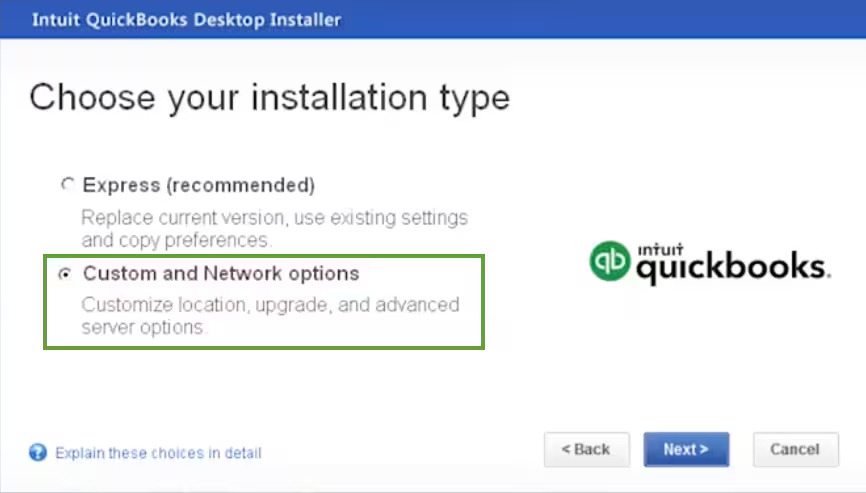

Step 2: Install QuickBooks Desktop again

- Once you are done with the uninstallation of QuickBooks and in case Windows signs in again, now, install QuickBooks Desktop.

- Confirm if the QuickBooks printing error has been resolved. In case it is not fixed, contact our Senior QuickBooks specialist immediately.

Conclusion

QuickBooks printing error is a common error that could pop up due to several issues, including issues in your system, printer box setup, or settings related to the printer. In this guide, we covered every possible fix that would help you get the error fixed.

However, some of the error requires an advanced solution depending on your system, settings, and printer product. In case you are not able to rectify the issue, reach out to our QuickBooksupportnet specialist at +1(866)500-0076 and get the error resolved ASAP.

Frequently Asked Questions

What are the causes behind the QuickBooks printing error?

There are multiple reasons that contribute to QuickBooks printing errors:

- Outdated Windows and QuickBooks applications.

- Printer Driver issue

- The printer may be offline

- There is a settings issue in the system.

- Improper connection between the system and the printer.

How can I fix the PDF and print issues in the QuickBooks Desktop?

To fix the PDF and print issues, follow our guide on QuickBooks PDF missing component.

Where can I contact to get the printing issue in QuickBooks fixed quickly?

If you are looking for a quick resolution to get the printing error fixed, dial +1(866)500-0076 and get it fixed.